Beyond Short-

Term Profits

Nurturing People

Process Excellence

& Governance

Planet & Society

Our Associates

INTRODUCTION

Axiata Group Berhad | Sustainability & National Contribution Report 2016

17

INTRODUCTION

National

Contribution Report

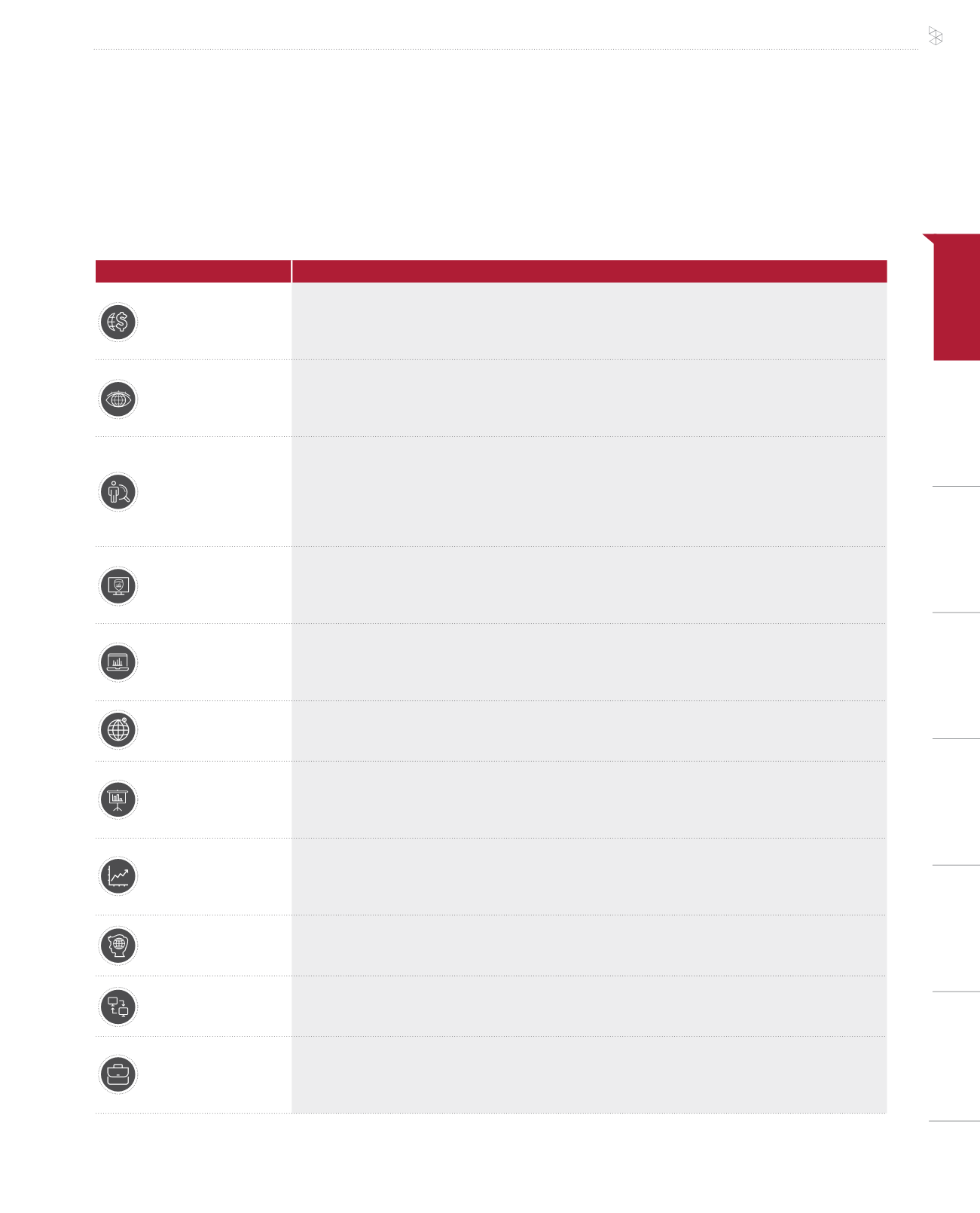

RISK

MANAGEMENT

Principally, the Group’s key risk factors are categorised into the following 11 areas:

Risk Category

Mitigation

Financial Risk

The Axiata Treasury Management Centre has been tasked to oversee and control the Group’s treasury and

funding matters, by developing hedging strategies which are governed strictly by the treasury policies, taking

into consideration current and future outlook of the relevant economies and foreign exchange markets with

the ultimate objective of preserving the Group’s profitability and sustainability.

Market Risk

The Group takes necessary measures to drive efficiencies and innovations through investments in new

technologies, establishing strategic ties with “Over-the-Top” (OTT) or other digital product developers in order

to create products and services that meet evolving customer needs, increase the Group’s share of customers’

wallets and rebuild customer loyalty.

Regulatory Risk

The Group advocates strict compliance, transparency and putting our case before the relevant authorities. The

Group has also been at the forefront in engaging regulatory officials, participating in government consultations

and sharing knowledge and best practices in the development of healthy regimes for the telecoms sector.

Underpinning the Group Regulatory Policy is the understanding that the Group shall comply with all applicable

laws and regulations, regulatory obligations and governmental policies in the jurisdictions in which it operates,

and that regulatory advice should be obtained in an efficient and cost effective manner as and when required.

Cyber Risk

The Group has established a Cyber Security Steering Committee focused on the accelerated implementation of

security initiatives. The committee is at the forefront of safeguarding the Group by ensuring strict compliance

with security policies, procedures and putting in place technologies and tools to minimise the risk of security

breaches.

Operational Risk

The Group continuously addresses issues such as network congestions, dropped calls, upgrades to network

coverage, etc. to ensure better quality network and service delivery. As at the end of 2016, the Group has

completed the implementation of its Business Continuity Management (BCM) Framework for selected OpCos

including the Axiata Corporate Centre.

Geopolitical Risk

The Group works closely with the respective OpCo Management, leveraging on local expertise, knowledge

and ability to continually assess the political situation and have in place various measures to ensure a timely

response in the event of geopolitical-related events.

Strategic Risk

The Group closely monitors the competitive landscape, explores and makes appropriate investments to

upgrade its technology and platform and reviews the relevance of its products and services. Prudent cost

management keeps our budget lean while maintaining strong strategic alliances with network vendors helps

us to keep pace with technology shifts.

Investment Risk

We have put in place a Mergers and Acquisitions Committee that oversees all acquisitions and divestments,

and at the same time maintain a robust due diligence process to evaluate and manage the potential risks

involved. Post-acquisition, transition teams are put together to ensure that organisational, cultural and mind-

set changes that are required are implemented appropriately.

People Risk

We develop our people through robust talent development programmes, attractive performance-based

rewards and by providing a safe and healthy work environment. Employee engagement is also critical for the

Group.

Technology Risk

The Group constantly reviews and refreshes its technology while maintaining financial prudence. The Group has

recently reviewed and revamped its capital expenditure (capex) governance and business planning process,

focusing on prudent cost management and capex productivity.

Governance and

Integrity Risk

The Group’s Code of Conduct sets out rules and guidelines on how personnel acting for or on behalf of

the Group are expected to conduct business. The Group will continue its focus on maintaining and further

developing its strong ethical platform and corporate governance standard to support Axiata’s business

integrity and strong performance.