Axiata Group Berhad | Annual Report 2016

FINANCIAL STATEMENTS

162

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2016

5.

INCORPORATIONS, ACQUISITIONS, DISSOLUTIONS AND DILUTIONS OF INTERESTS (CONTINUED)

(b) Incorporations, acquisitions and dilutions of interests in the previous financial year (continued)

(xiv) Investment in Headstart (Private) Limited (“Headstart”)

On 4 September 2014, Dialog entered into an investment agreement with Headstart to purchase its redeemable convertible bonds

which will mature on 31 December 2021, at a nominal value of SLR85.0 million.

On 27 November 2015, Dialog transferred its investment in redeemable convertible bonds amounting to SLR60.0 million to DHL by way

of a deed of assignment. On 31 December 2015, DHL converted SLR20.0 million of its investment in redeemable convertible bonds into

equity shares of Headstart which is representing 26.00% of the issued and paid up capital of Headstart. Accordingly, Headstart became

an associate of the Group.

The above investment had no significant impact to the Group in the financial year.

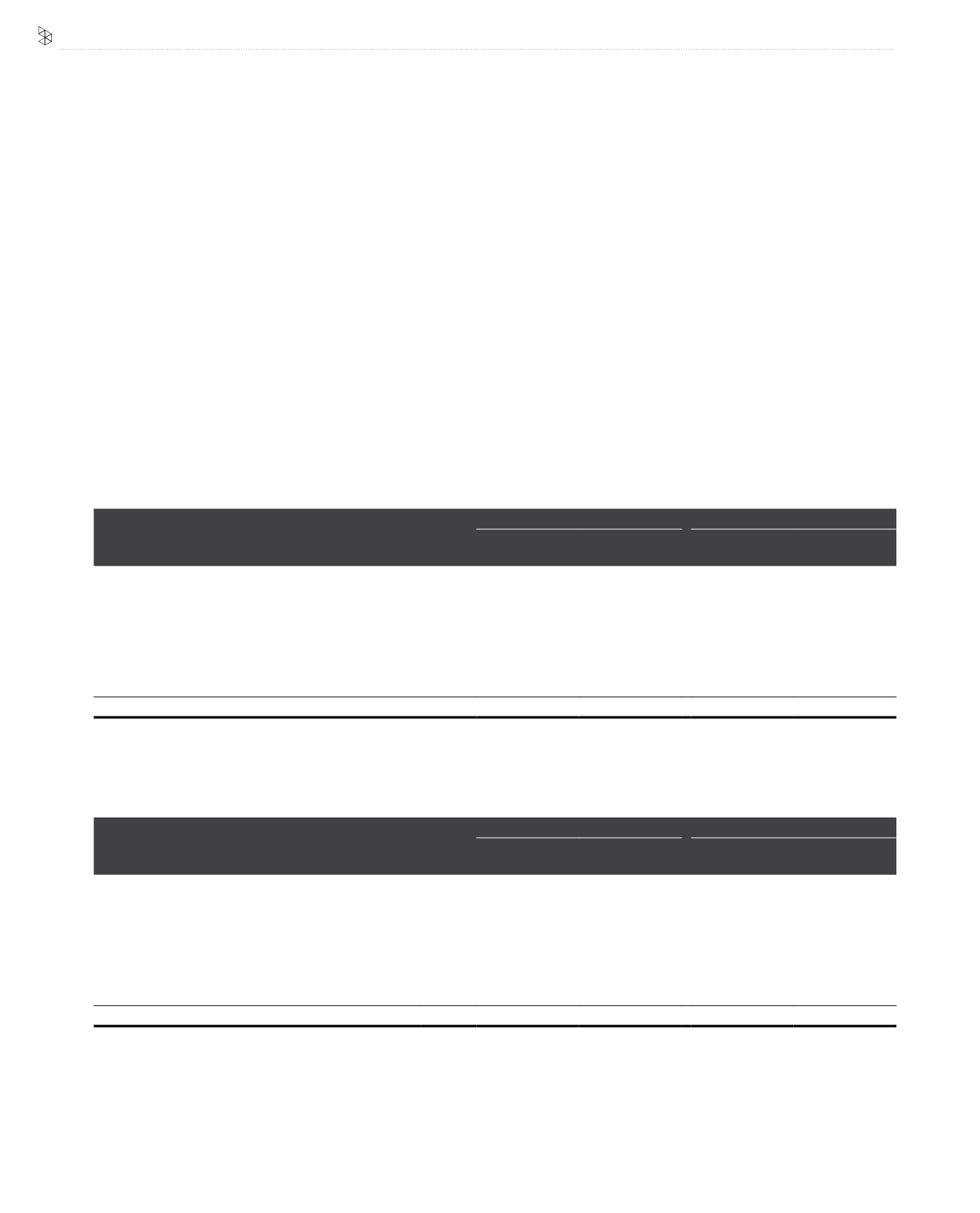

6.

OPERATING REVENUE

Group

Company

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

Mobile services

16,938,170

16,418,299

-

-

Interconnect services

1,627,048

1,221,636

-

-

Dividend income

-

-

1,002,403

1,101,406

Lease and services of passive infrastructure

372,141

199,456

-

-

Technical and management services fees

-

-

47,435

48,142

Others*

2,628,033

2,044,069

-

-

Total

21,565,392

19,883,460

1,049,838

1,149,548

* Others include revenue from pay television transmission, sale of devices and other data services.

7(a). DEPRECIATION, IMPAIRMENT AND AMORTISATION

Note

Group

Company

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

Depreciation of PPE

26

4,964,247

3,878,057

8,431

6,623

Reversal of impairment of PPE

26

-

(5,089)

-

-

Impairment of PPE

26

62,366

10,934

-

-

Write off of PPE

26

8,916

22,653

-

426

Amortisation of intangible assets

25

630,661

291,698

-

-

Others

315

294

-

-

Total

5,666,505

4,198,547

8,431

7,049