FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

157

5.

INCORPORATIONS, ACQUISITIONS, DISSOLUTIONS AND DILUTIONS OF INTERESTS (CONTINUED)

(a) Incorporations, acquisitions, dissolutions and dilutions of interests during the financial year (continued)

(xiii) Amalgamation/Merger of Robi Axiata Limited (“Robi”) and Airtel Bangladesh Limited (“Airtel”) (continued)

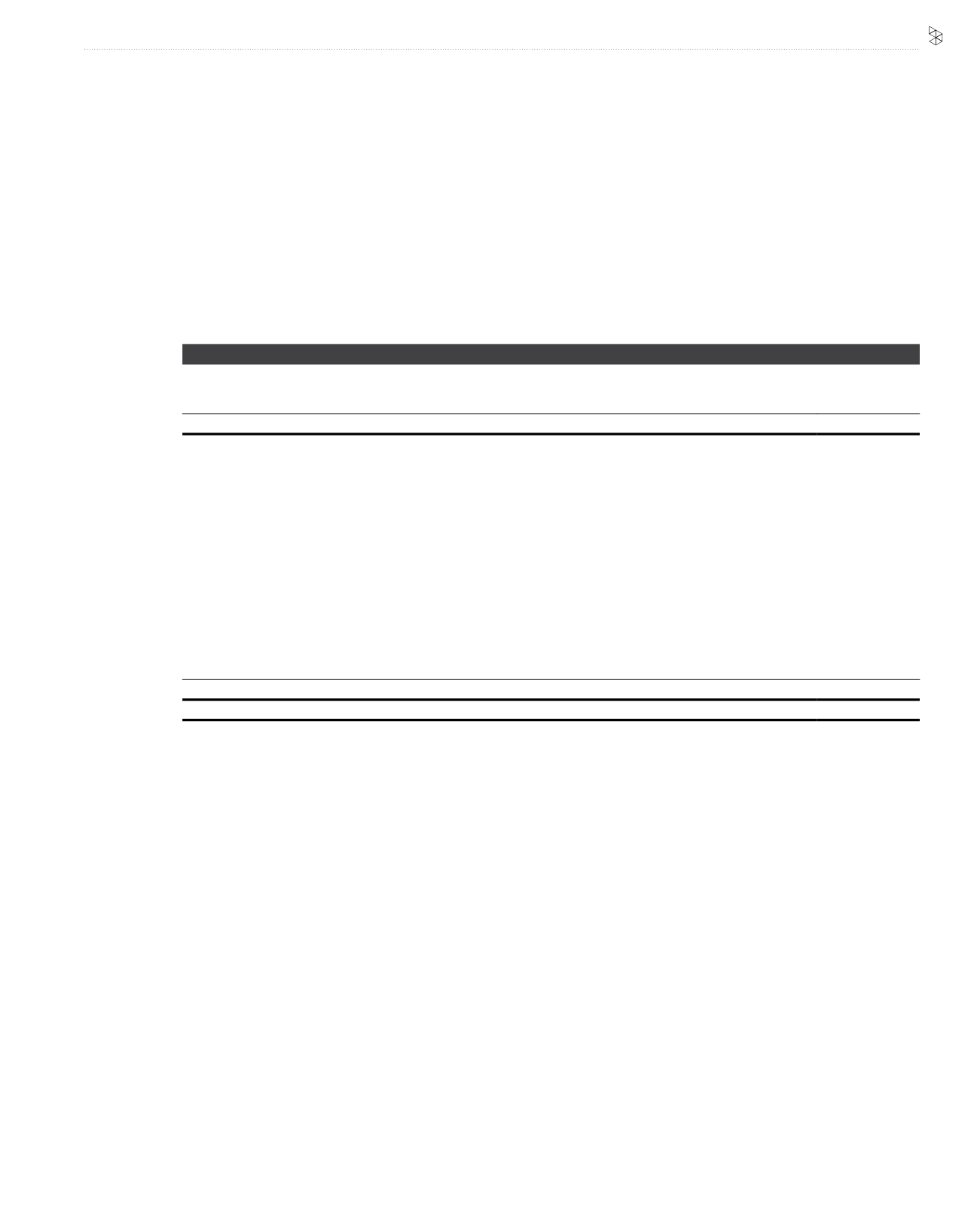

The following summarises the non-cash consideration on the acquisition of Airtel, the fair value of the identifiable assets acquired,

liabilities assumed and NCI on the date of acquisition.

RM’000

Purchase consideration issued in ordinary shares of Robi based on estimated enterprise value of Airtel

1,020,640

Contingent consideration

106,865

1,127,505

Details of the net identifiable net assets acquired are as follows:

PPE

735,823

Intangible assets

568,084

Indemnification assets*

162,352

Trade and other receivables

151,699

Advance tax

12,927

Cash and bank balances

43,906

Deferred tax assets

374,513

Borrowings

(479,552)

Trade and other payables

(441,897)

Provision for liabilities

(20,991)

Total net identifiable assets

1,106,864

Goodwill on acquisition

20,641

*

To indemnify certain corporate tax of previous tax assessment years and trade payables related to value added taxes.

The Group has assessed the fair value of the identified assets acquired and liabilities assumed on the date of acquisition via purchase

price allocation (“PPA”) exercise. However MFRS 3 allows any adjustments to PPA up to twelve (12) months period from the date of

acquisition.

The goodwill arising from acquisition is attributable to the expected synergies from the amalgamation/merger.

Acquisition related costs of RM59.9 million have been charged to other operating costs in the consolidated profit or loss during the

financial year.

Had Airtel been consolidated from 1 January 2016 until 15 November 2016, consolidated revenue and profit after tax of the Group would

have been increased by RM668.5 million and decreased by RM390.2 million respectively.

Since the acquisition date, revenue amounting to RM79.7 million and loss after tax of RM57.7 million of Airtel respectively have been

included in the consolidated statement of comprehensive income during the financial year.

With the completion of the acquisition, the Group’s effective equity interest in Robi decreased from 91.59% to 68.69%. Accordingly

the Group recorded an increase in consolidated retained earnings of RM118.1 million and non-controlling interests of RM902.5 million

respectively.