FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

161

5.

INCORPORATIONS, ACQUISITIONS, DISSOLUTIONS AND DILUTIONS OF INTERESTS (CONTINUED)

(b) Incorporations, acquisitions and dilutions of interests in the previous financial year (continued)

(xii) Acquisition of 75.00% equity interest in edotco SG

On 2 October 2015, EIL, a wholly-owned subsidiary of edotco Group Sdn Bhd (“edotco Group”) entered into a SPA with edotco SG to

acquire a 75.00% equity interest in edotco SG, the parent of edotco Myanmar Limited.

On 4 December 2015, EIL completed the acquisition for a total cash consideration of RM528.5 million (USD125.0 million).

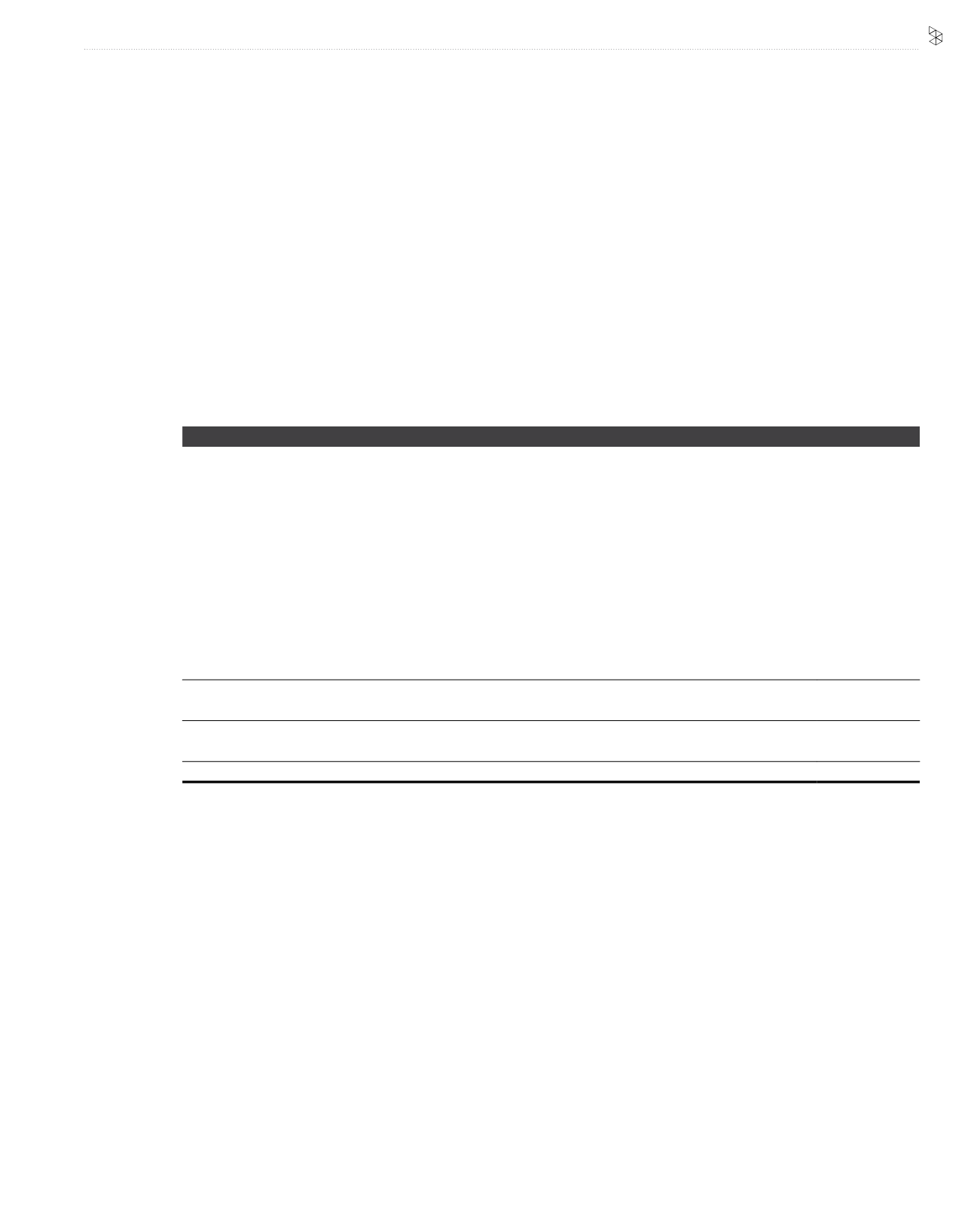

The following summarises the consideration paid, the fair value of the identifiable assets acquired and liabilities assumed at the

acquisition date.

RM’000

Net purchase consideration in cash

528,500

Details of the net identifiable assets acquired are as follows:

PPE

497,007

Intangible assets

358,534

Trade and other receivables

25,228

Cash and bank balances

52,520

Provision for liabilities

(66,221)

Trade and other payables

(47,745)

Tax liabilities

(2,938)

Borrowings

(249,410)

Total net identifiable assets

566,975

Less: NCI

(141,744)

Total net identifiable assets acquired, net of NCI's shares

425,231

Goodwill on acquisition

103,269

528,500

The Group has assessed the fair value of the identified assets acquired and liabilities assumed on the date of acquisition via purchase

price allocation (“PPA”) exercise. However MFRS 3 allows any adjustments to PPA up to twelve (12) months period from the date of

acquisition.

The goodwill arising from acquisition is attributable to the expansion of regional footprint in Myanmar.

Acquisition related costs of RM4.4 million have been charged to other operating costs in the consolidated profit or loss in the previous

financial year.

The impact of acquisition of edotco SG and its subsidiary had it occurred on 1 January 2015 and from the date of acquisition, was not

material to the consolidated financial statements.

In addition to the SPA, EIL also entered into a Put & Call Option Agreement with Yoma which is the NCI of edotco SG for the acquisition

of 25.00% interest in edotco SG together with shareholder's loan, owned by Yoma as disclosed in Note 19(d) to the financial statements.

(xiii) Incorporation of Axiata Investments (UK) Limited (“Axiata UK”)

On 14 December 2015, Axiata UK was incorporated with an issued and paid-up share capital of GBP1 divided into 1 ordinary share. The

nature of business to be carried by Axiata UK is as an investment holding company.

The above incorporation did not have significant impact to the Group in the previous financial year.