Axiata Group Berhad | Annual Report 2016

FINANCIAL STATEMENTS

164

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2016

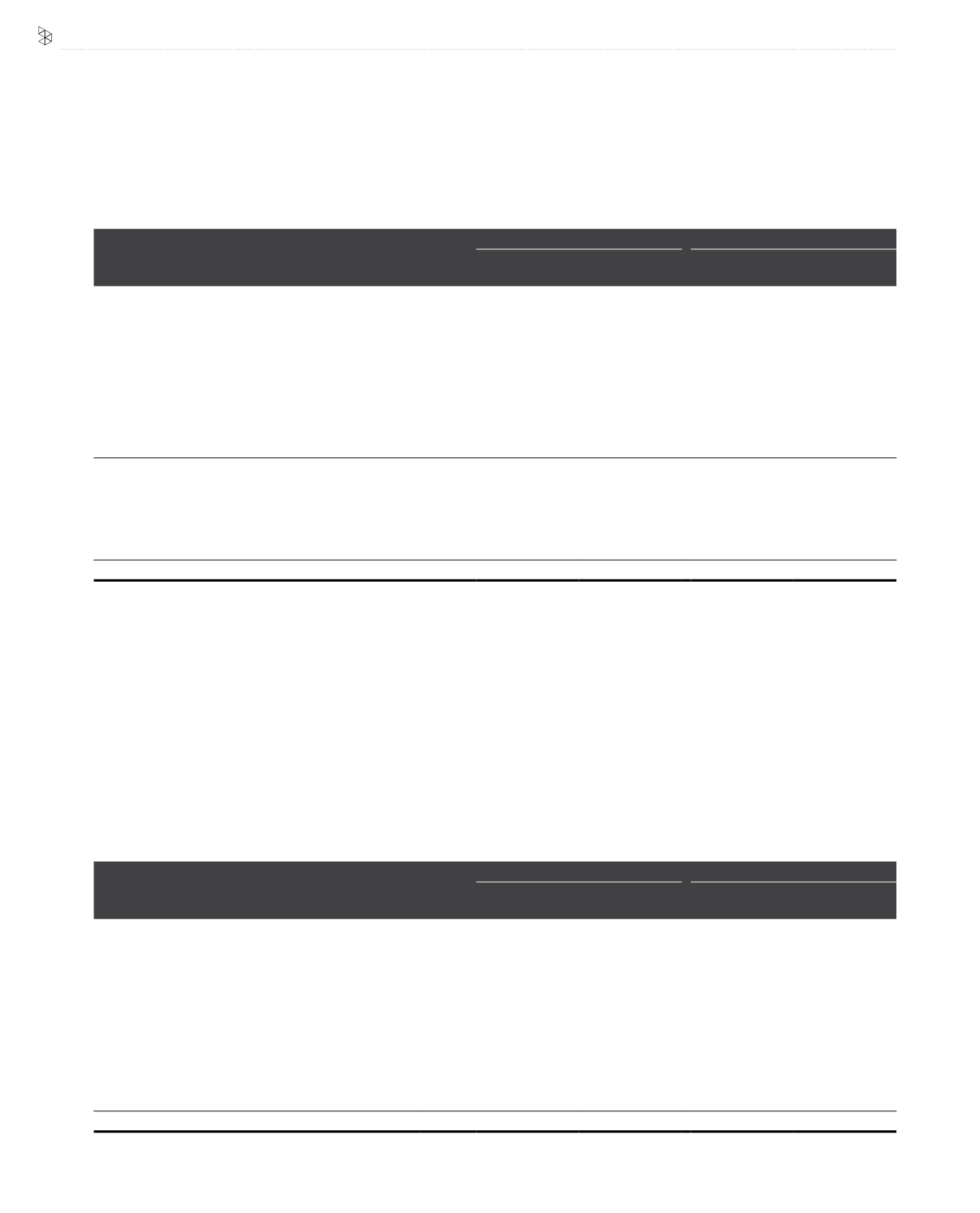

7(b). OTHER OPERATING COSTS (CONTINUED)

Group

Company

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

1

Others include:

Audit fees:

- PricewaterhouseCoopers Malaysia (“PwCM”)

3,742

2,525

2,113

1,175

- Member firm of PwC International Limited (“PwCI”)*

4,667

3,656

-

-

- Others

147

60

-

-

Audit related fees

(i)

:

- PwCM and PwCI

3,914

6,438

2,651

1,866

12,470

12,679

4,764

3,041

Other fees paid to PwCM and PwCI:

- Tax and tax related services

(ii)

581

1,065

101

332

- Other non-audit services

(iii)

12,354

4,265

884

1,750

Total

25,405

18,009

5,749

5,123

*

Separate and independent legal entity from PwCM.

(i)

Fees incurred in connection with performance of quarterly reviews, review of purchase price allocation, agreed-upon procedures and

regulatory compliance.

(ii)

Fees incurred for assisting the Group in connection with tax compliance and advisory services.

(iii)

Fees incurred primarily in relation to due diligences on potential acquisitions, project management and other advisory services mainly incurred

by a foreign subsidiary

In order to maintain the independence of the external auditors, the Audit Committee has determined policies as to what non-audit services can be

provided by external auditors of the Group and the approval processes related to them. Under these policies and guidelines, non-audit services can

be offered by external auditors of the Group if there are clear efficiencies and value-added benefits to the Group.

7(c). STAFF COSTS (including remuneration of Executive Directors of the Company)

Note

Group

Company

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

Staff costs excluding Directors:

- salaries, allowances, overtime and bonus

1,140,643

888,338

66,290

59,752

- termination benefits

47,992

106,977

-

-

- contribution to EPF

93,077

86,587

11,778

10,969

- other staff benefits

220,662

156,512

15,400

10,646

- ESOS and RSA expenses

14(a)

28,345

52,502

11,218

5,298

- Share based compensation expense of a subsidiary

14(b)

15,650

9,787

-

-

- Pioneer Grant of a subsidiary

14(c)

9,896

11,724

-

-

Remuneration of Executive Directors of the Company

7(d)

8,445

6,956

8,445

6,956

Total

1,564,710

1,319,383

113,131

93,621