Axiata Group Berhad | Annual Report 2016

FINANCIAL STATEMENTS

168

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2016

11. TAXATION AND ZAKAT (CONTINUED)

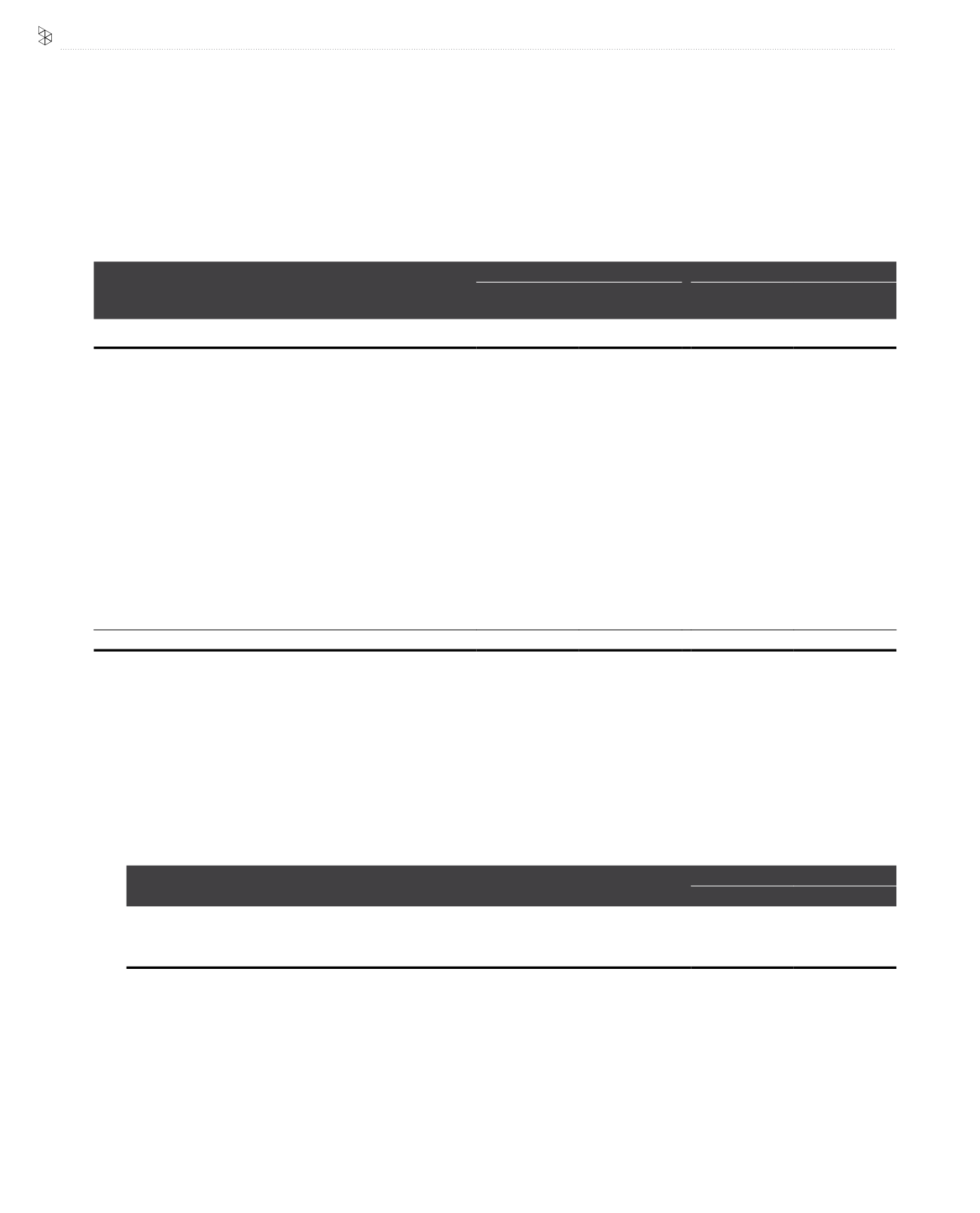

Numerical reconciliation between taxation and the product of accounting profit multiplied by the Malaysian tax rate:

Group

Company

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

Profit before taxation

1,139,580

3,331,142

1,222,428

3,071,424

Taxation calculated at the applicable Malaysian tax rate of 24%

(2015: 25%)

273,499

832,786

293,383

767,856

Tax effects of:

- income not subject to tax

(150,671)

(336,521)

(362,361)

(805,073)

- share of results of associates

(31,470)

(122,377)

-

-

- share of results of joint ventures

23,002

9,647

-

-

- different tax rates in other countries

(48,541)

83,803

-

-

- utilisation of previously unrecognised tax losses

(3,444)

(14)

(3,421)

-

- unrecognised tax losses

27,697

34,440

5,328

7,625

- expenses not deductible for tax purposes

410,354

139,679

54,489

15,095

- group relief

-

-

15,600

15,000

- prior year income tax

(19,814)

53,368

16,108

-

- zakat

1,810

263

-

-

Total taxation and zakat

482,422

695,074

19,126

503

Included in the taxation of the Group are tax savings amounting to RM20.4 million (2015:RM15.0 million) due to Group Relief which allows companies

with tax losses to surrender those losses to profit-making companies within the Group in the same year of assessment as provided under the

taxation law of Malaysia.

12. EARNINGS PER SHARE

(a) Basic earnings per share (“EPS”)

Basic EPS of the Group is calculated by dividing the profit attributable to owners of the Company by the weighted average number of ordinary

shares of the Company in issue during the financial year.

Group

2016

2015

Profit attributable to owners of the Company (RM’000)

504,254

2,554,220

Weighted average number of shares in issue ('000)

8,877,928

8,668,700

Basic EPS (sen)

5.7

29.5