FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

167

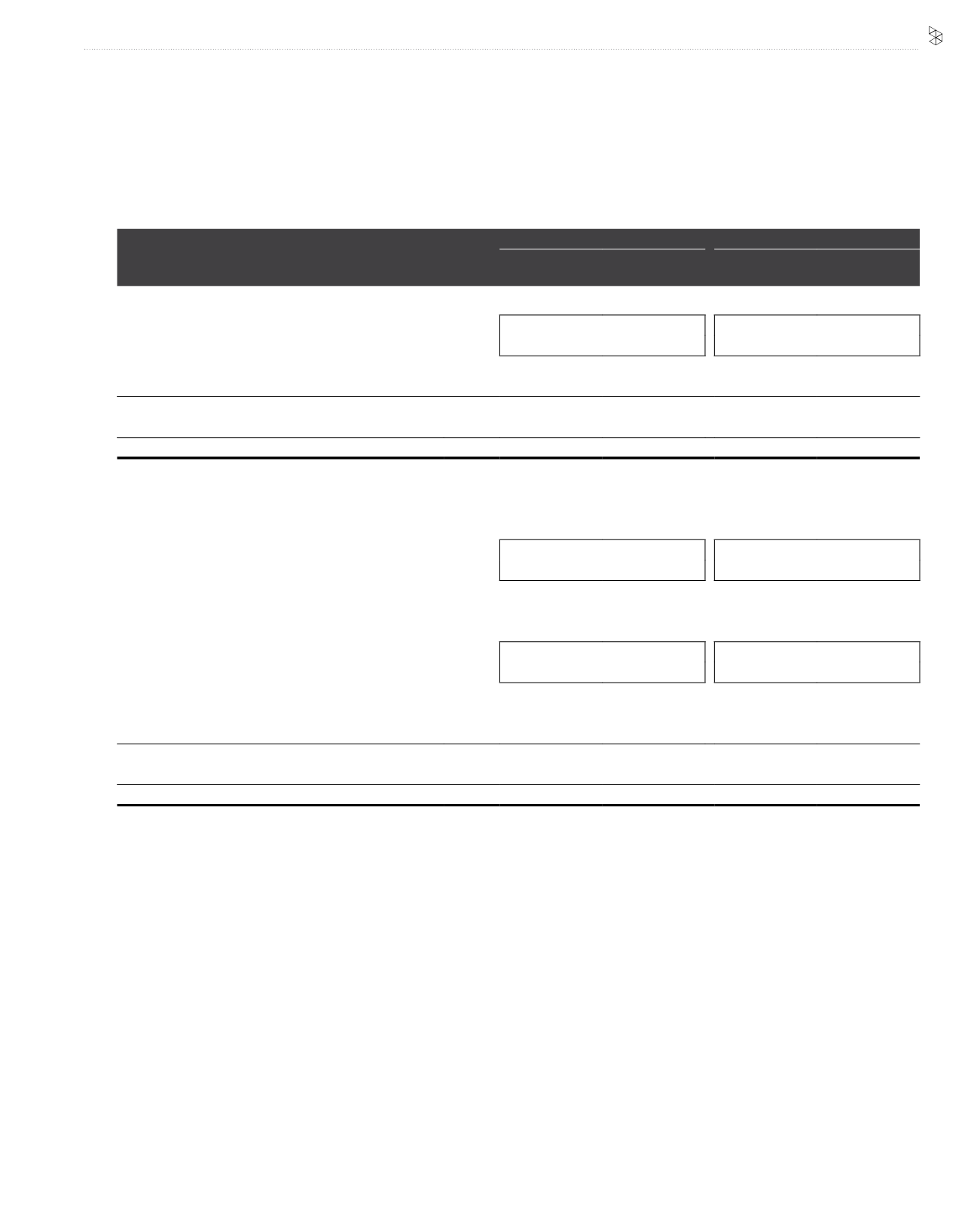

11. TAXATION AND ZAKAT

Note

Group

Company

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

Current taxation:

- Malaysian income tax

119,926

461,949

-

-

- Overseas taxation

437,163

269,817

19,126

503

557,089

731,766

19,126

503

Deferred taxation

24

(76,477)

(36,955)

-

-

Total taxation

480,612

694,811

19,126

503

Zakat

1,810

263

-

-

Total taxation and zakat

482,422

695,074

19,126

503

Current taxation:

Malaysia

Income tax:

- Current year

155,848

460,090

-

-

- Prior year

(35,922)

1,859

-

-

119,926

461,949

-

-

Overseas

Income tax:

- Current year

421,055

218,308

3,018

503

- Prior year

16,108

51,509

16,108

-

437,163

269,817

19,126

503

Deferred taxation:

- Net origination of temporary differences

24

(76,477)

(36,955)

-

-

Total taxation

480,612

694,811

19,126

503

Zakat

1,810

263

-

-

Total taxation and zakat

482,422

695,074

19,126

503