FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

155

5.

INCORPORATIONS, ACQUISITIONS, DISSOLUTIONS AND DILUTIONS OF INTERESTS (CONTINUED)

(a) Incorporations, acquisitions, dissolutions and dilutions of interests during the financial year (continued)

(vii) Acquisition of Reynolds Holdings Limited (“Reynolds”) by Axiata Investments (UK) Limited (“Axiata UK”) (continued)

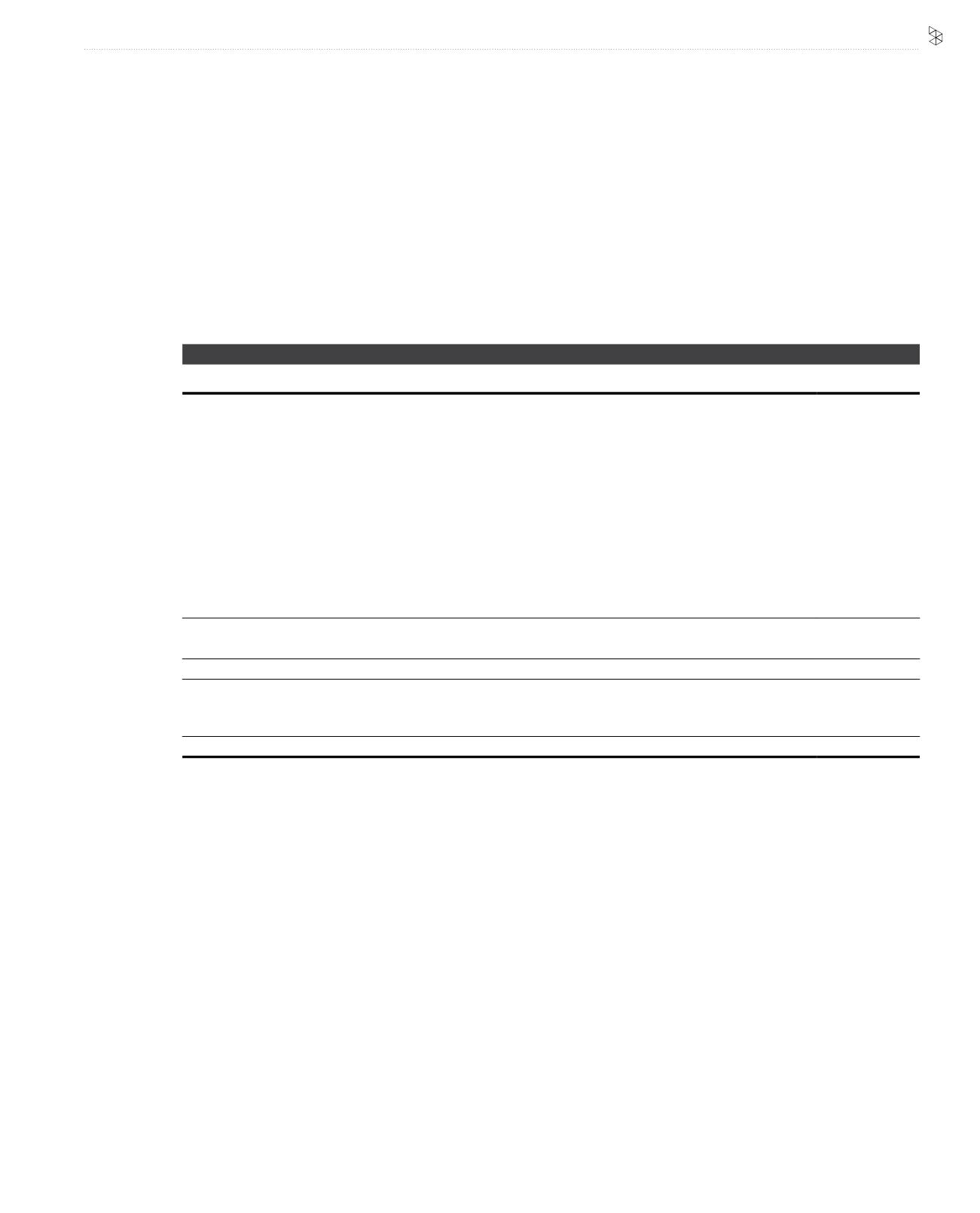

The following summarises the consideration paid on the acquisition of Reynolds at consolidated basis, the fair value of the identifiable

assets acquired, liabilities assumed and NCI at the acquisition date.

RM’000

Purchase consideration as per the SPA in cash

5,327,469

Details of the net identifiable assets acquired are as follows:

PPE

1,404,320

Intangible assets

3,559,641

Inventories

4,526

Trade and other receivables

853,141

Cash and bank balances

1,626,407

Deferred tax liabilities

(754,266)

Provision for liabilities

(35,822)

Trade and other payables

(1,595,788)

Tax liabilities

(194,159)

Total net identifiable assets

4,868,000

Less: NCI

(911,746)

Total net identifiable assets acquired, net of NCI's shares

3,956,254

Closing statement adjustments of RM980.6 million and liability incurred of RM608.4 million which were part of the

total purchase consideration for goodwill computation purpose.

1,589,037

Goodwill on acquisition

2,960,252

The Group has assessed the fair value of the identified assets acquired and liabilities assumed on the date of acquisition via purchase

price allocation (“PPA”) exercise. However MFRS 3 allows any adjustments to PPA up to twelve (12) months period from the date of

acquisition.

The goodwill arising from acquisition is attributable to the expansion of regional footprint in Nepal.

Acquisition related costs of RM25.4 million have been charged to other operating costs in the consolidated profit or loss during the

financial year.

Had Reynolds and its subsidiary been consolidated from 1 January 2016 until 10 April 2016, consolidated revenue and profit after tax of

the Group would have been increased by RM628.4 million and RM218.4 million respectively.

Since the acquisition date, revenue amounting to RM1,629.5 million and profit after tax of RM568.4 million of Ncell respectively have been

included in the consolidated statement of comprehensive income during the financial year.

(viii) Incorporation of VM Digital (Thailand) Co., Ltd. (“VM Digital”)

Axiata Digital Services Sdn Bhd (“ADS”), had on 3 May 2016 completed the incorporation of VM Digital (Registration No. 0105559069905),

a private company limited by shares, in Thailand, under the Thailand Civil and Commercial Code.

VM Digital was incorporated with a registered share capital of THB1.0 million. The nature of business to be carried by VM Digital is to

operate telecommunications and all types of communications businesses.

The above incorporation did not have any significant impact to the Group during the financial year.