Introduction

NATIONAL

CONTRIBUTION REPORT

Beyond Short-

Term Profits

Nurturing People

Process Excellence

& Governance

Planet & Society

Our Associates

NATIONAL CONTRIBUTION REPORT 71

Axiata Group Berhad | Sustainability & National Contribution Report 2016

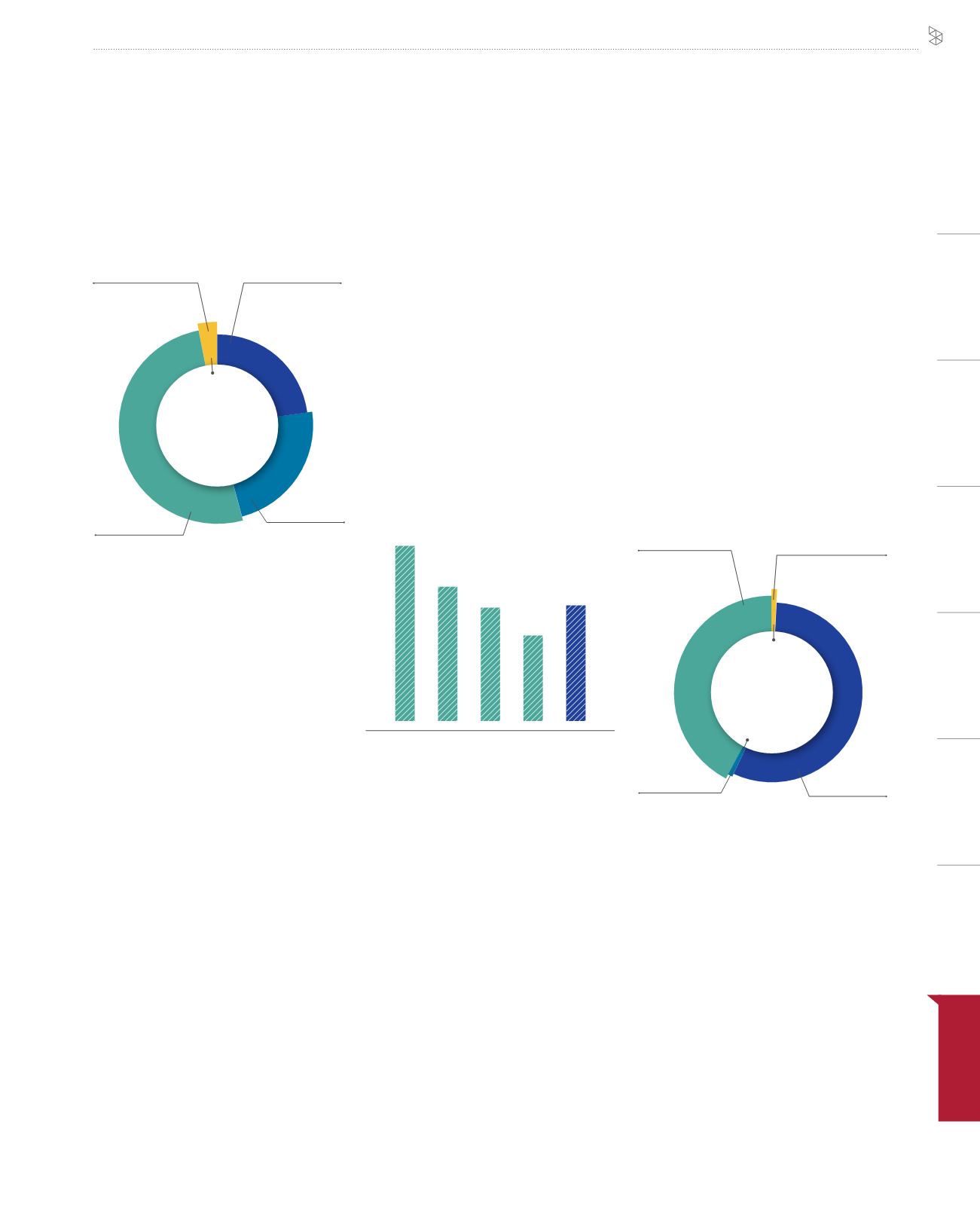

Figure 1: GVA contribution to the

Indonesian economy 2016

Figure 2: Total capital investment:

2012-2016

Figure 3: Total employment impact

2016

56%

42%

66,019

1,892

930

89,568

Supported by

capital investment

Directly

employed

Outsourced

Operations -

indirectly

supported

158,409

Jobs

supported

2012

746

572

486

362

487

USD million

2013 2014 2015

2016

Economic and Financial Contributions

XL’s total Gross Value Added (GVA) to the

Indonesian economy was approximately

USD3,058 million comprising direct

operational contributions of USD698

million, indirect operational contributions

of USD714 million, capital investment

contributions of USD104 million and

productivity gains of USD1,543 million (see

Figure 1). Productivity gains are defined as

the improvement in national productivity

due to the rise in the mobile penetration

rate. The total GVA of USD3,058 million

was derived from XL’s total opex and capex

of USD998 million and USD487 million

respectively, and the 10.9% increase in the

mobile penetration rate. Every USD1 spent

by XL in Indonesia through its operations

and capital investment added USD1.2 in

GVA to the Indonesian economy in 2016.

Investing and Innovating for the Long

Term

XL invested a total of USD2,652 million

between 2012 and 2016 to improve its

network and in launching new innovative

products and services (see Figure 2). The

OpCo’s total investment of USD487 million

in 2016 represented a 34.6% increase from

USD362 million in 2015. XL further invested

in the country and continued to innovate on

its VAS and quality of services to grow its

presence in the country.

23%

51%

23%

USD104 million

USD698 million

USD1,543 million

USD714 million

GVA by capital

investment

Operational

direct GVA

GVA by productivity

Operational

Indirect and

Induced GVA

USD3,058

million

3%

Contributions to Public Finance

XL contributed USD120 million in taxes

to the Indonesian Government in 2016,

accounting for 0.1% of the country’s total

tax revenue. XL’s tax commitments in

Indonesia include direct taxes such as

corporate and withholding tax, as well as

indirect taxes such as value-added tax and

licensing fees.

Talent Development

XL provided 1,892 direct jobs in 2016 of

which 99% of positions were staffed by

Indonesian citizens. About 32% of XL

employees were women. During the year,

XL engaged 46 new graduates, apprentices

and interns as part of its goal to provide

young people with specialist skills required

in the digital economy. XL’s operations also

indirectly supported an additional 89,600

jobs and outsourced a further 930 jobs. Its

capital investments, meanwhile, supported

66,000 jobs (see Figure 3).

1%

1%

Note: As a % of total GVA contribution; Numbers may not balance due to rounding

NATIONAL CONTRIBUTION

REPORT