Introduction

NATIONAL

CONTRIBUTION REPORT

Beyond Short-

Term Profits

Nurturing People

Process Excellence

& Governance

Planet & Society

Our Associates

NATIONAL CONTRIBUTION REPORT 75

Axiata Group Berhad | Sustainability & National Contribution Report 2016

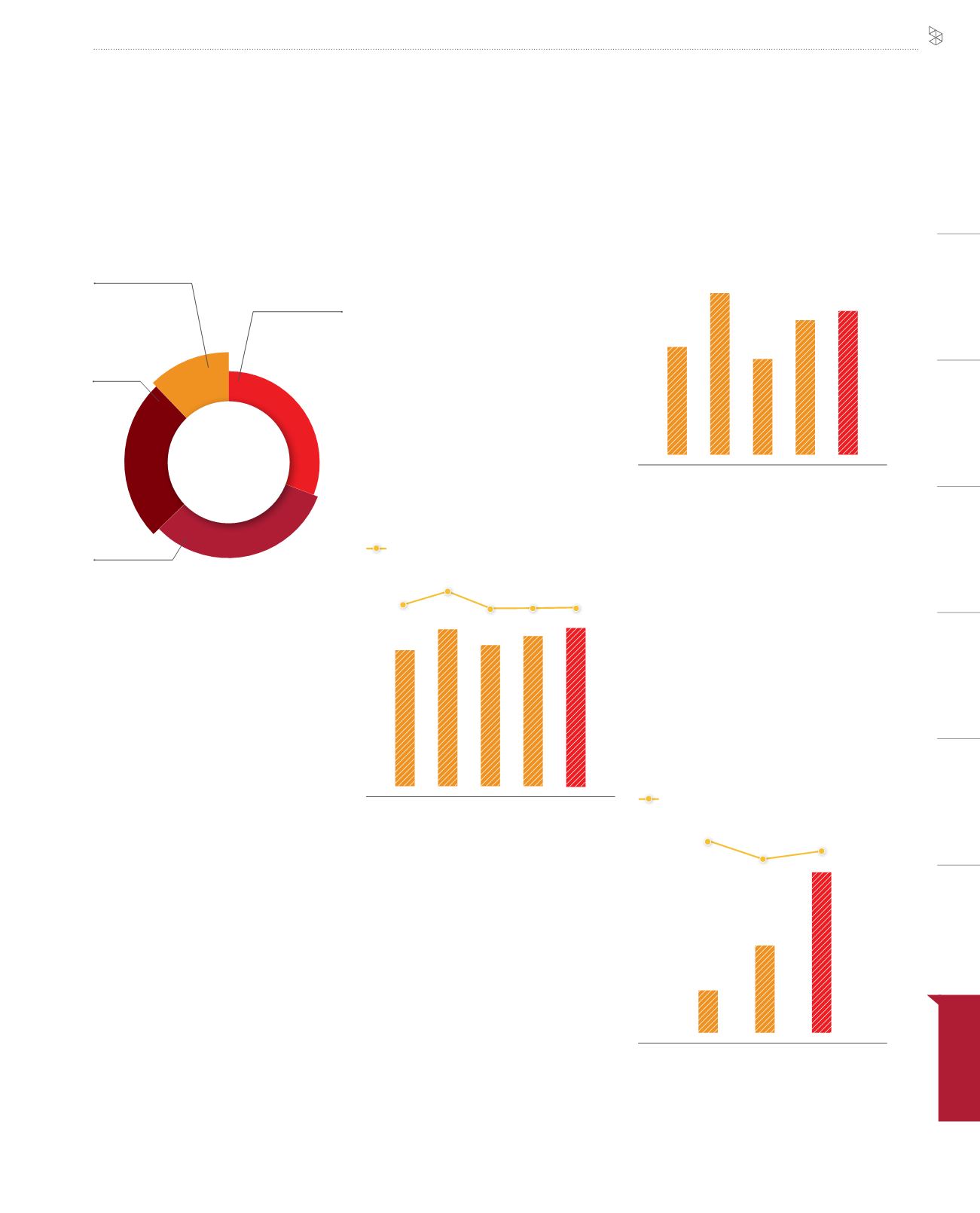

Figure 2: GVA contribution to the Sri

Lankan economy, 2012-2016

Figure 3: Total capital investment:

2012-2016

Figure 1: GVA contribution to the Sri

Lankan economy 2016

USD93 million

USD250 million

USD257 million

USD203 million

GVA by capital

investment

Operational

direct GVA

Operational Indirect and Induced GVA

GVA by

productivity

31%

32%

25%

12%

USD804

million

Economic and Financial Contributions

Dialog’s Gross Value Added (GVA)

in 2016 was estimated at USD804

million comprising direct operational

contributions of USD250 million, indirect

operational contributions of USD257

million, capital investment contributions

of USD93 million and productivity gains of

USD203 million (see Figure 1). Productivity

gains are defined as the improvement in

national productivity due to the rise in

mobile penetration rate. The total GVA of

USD804 million was derived from Dialog’s

total opex and capex of USD386 million

and USD180 million respectively, and the

4.8% increase in the mobile penetration

rate. Every USD1 spent by Dialog in Sri

Lanka through its operations and capital

investment added USD1.2 in GVA to the Sri

Lankan economy in 2016.

Dialog’s total GVA contribution increased

to USD804 million in 2016 from USD693

million in 2012, translating to a CAGR of

3.8% (see Figure 2). The improving trend

was due to increased operational profits

and a surge in the number of subscribers.

Over the last five years, total operational

profit grew to USD208 million in 2016

from USD142 million in 2012. The total

number of mobile subscribers in Sri Lanka

expanded to 26 million from 19 million

during the same time period translating to

a mobile penetration rate of 122% in 2016

(95% in 2012).

Contributions to Public Finance

Total tax contributions for Dialog from 2014

to 2016 totalled USD603 million, expanding

to USD217 million in 2016 from USD198

million in the previous year (see Figure 4).

Dialog’s tax contributions in 2016 accounted

for 2.2% of the Sri Lankan Government’s

total tax revenue. DIalog’s tax commitments

in Sri Lanka include direct taxes such as

corporate and withholding tax, as well as

indirect taxes such as value-added tax and

licensing fees.

2012

133

201

116

167

180

USD million

2013 2014 2015

2016

Investing and Innovating for the Long

Term

Dialog invested a total of USD799 million

between 2012 and 2016. The OpCo’s total

investment of USD180 million in 2016

represented a 7.9% increase from USD167

million in 2015 (see Figure 3). Dialog is

committed to further investing in Sri Lanka

so as to enhance its network coverage

and service quality in an increasingly

competitive market.

2012

693

803

717

765

804

USD million

2013 2014 2015

2016

1.1%

1.2%

1.0% 1.0% 1.0%

as a % of total GDP

Note: As a % of total GVA contribution; Numbers may not balance due to rounding

Figure 4: Total tax contribution to

public finance, 2014-2016

as a % of general Government tax revenue

2014

USD million

2015

2016

187

2.5%

2.1%

2.2%

198

217

Note: 2014-2016 General Government tax revenue

data is from Budget estimates 2015-2017, Ministry of

Finance, Sri Lanka

NATIONAL CONTRIBUTION

REPORT