GOVERNANCE

Axiata Group Berhad | Annual Report 2016

093

The BAC had on 16 January 2016, reviewed the re-appointment of PwC

based on the following criteria before making their recommendation:-

i)

Level of knowledge, capabilities, experience and quality of work;

ii) Level of engagement with the Chairman, BAC;

iii) Ability to provide constructive observations, implications and

recommendations in areas requiring improvements;

iv) Adequacy in audit coverage, effectiveness in planning and conduct of

audit;

v) Ability to perform audit work within agreed timeframe;

vi) Non-audit services rendered by the External Auditor does not impede

independence;

vii) Succession plan of partner-in-charge and rotation of audit partner is

evident; and

viii) Comprehensive audit plan addressing company/industry specific

objectives, geographical coverage, and level of resources and audit

tests with specialist input on tax and regulations.

In safeguarding and supporting the external auditor’s independence and

objectivity, Axiata has determined policies to restrict the type of non-audit

services that can be provided by external auditors of the Group and the

approval process related to them. Under these policies and guidelines, non-

audit services can be offered by external auditors of the Group if there are

clear efficiencies and value-added benefits to the Group and a detailed

review of non-audit fees paid to the external auditors is undertaken by

the BAC on a quarterly basis. These procedures are in place to ensure that

neither their independence nor their objectivity is put at risk, and steps

are taken to ensure that this does not impede the external auditors audit

works.

The BAC remains confident that the objectivity and independence of

the external auditors are not in any way impaired by reasons of the non-

audit services provided to the Group. The auditors of the Company, PwC,

annually confirms to the BAC their independence to the Group within the

meaning of the provisions of the Bye- Laws on Professional Independence

of the Malaysian Institute of Accountants and PwC’s firm’s requirements.

PwC, having reviewed the non-audit services provided to the Group during

the financial year 2015 in accordance with the independence requirements

and, to the best of their knowledge, are not aware of any non-audit

services that had compromised their independence as external auditors

of the Group.

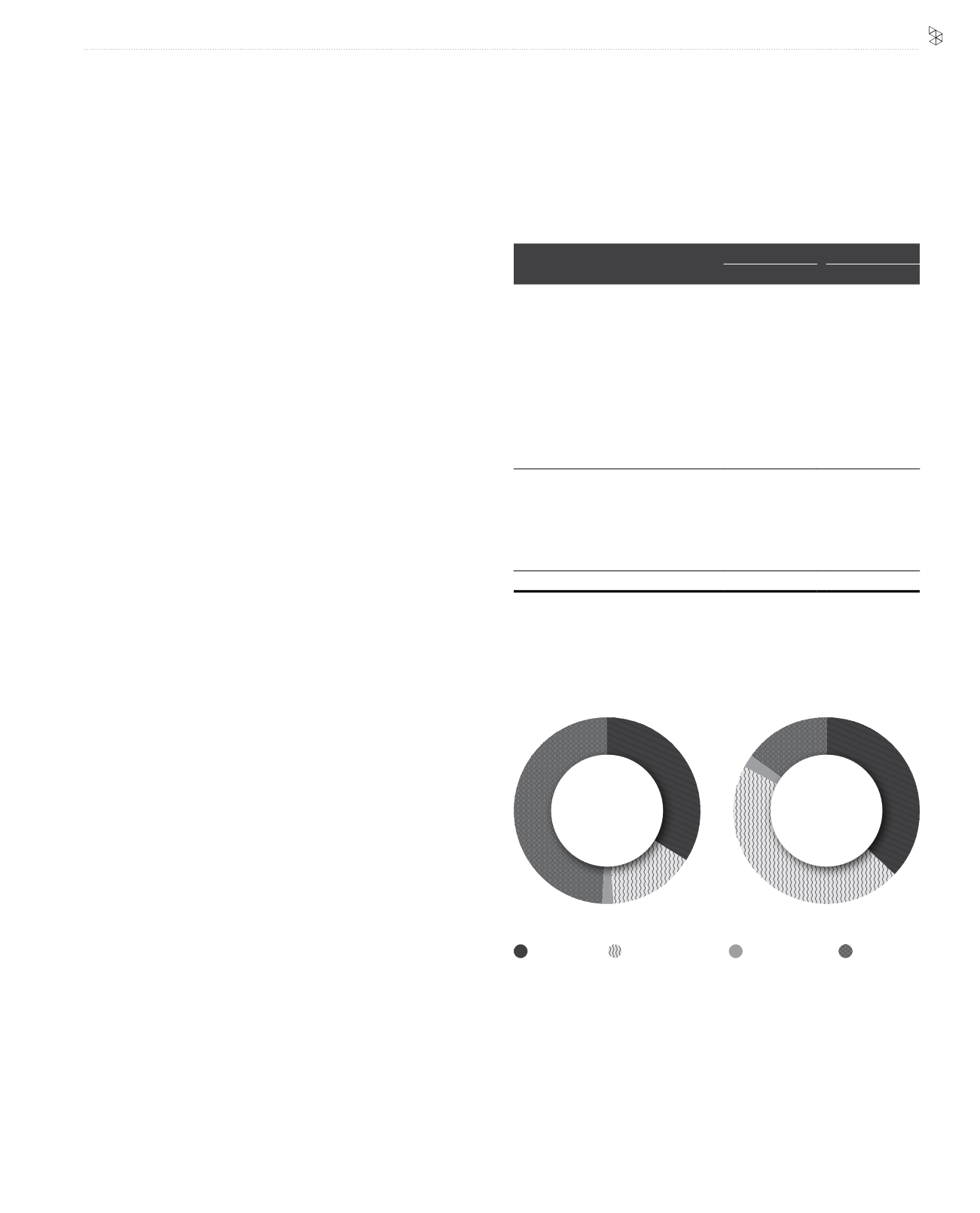

Audit Fees

Audit Related

Fees

Tax and Tax

Related Fees

Other Non-

Audit Fees

34%

2%

15%

37%

46%

15%

2%

49%

Details of statutory audit, audit-related and non-audit fees paid/payable in

2016 to the external auditors are set out below:-

Group

Company

RM'000

RM'000

Audit fees:

- PricewaterhouseCoopers Malaysia

(PwCM)

3,742

2,113

- Member firm of PwC International

Limited (PwCI)*

4,667

-

- Others

147

-

Audit related fees

1

- PwCM and PwCI

3,914

2,651

12,470

4,764

Other fees paid to PwCM and PwCI:

- Tax and tax related services

2

581

101

- Other non-audit services

3

12,354

884

25,405

5,749

*

Separate and independent legal entity from PwCM

1

Fees incurred in connection with performance of quarterly reviews, review of

purchase price allocation, agreed-upon procedures and regulatory compliance

2

Fees incurred for assisting the Group in connection with tax compliance and

advisory services

3

Fees incurred primarily in relation to due diligence on potential acquisitions, project

management and other advisory services mainly incurred by a foreign entity

Group

Company