Axiata Group Berhad | Annual Report 2016

GOVERNANCE

096

Board of

Directors

STATEMENT ON RISK MANAGEMENT AND

INTERNAL CONTROL

Pursuant to Paragraph 15.26(b) of the Main Listing Requirements (LR) of Bursa Malaysia Securities Berhad (Bursa

Securities), the Board of Directors of listed issuers is required to include in their annual report, a ‘statement about the

state of risk management and internal controls of the listed issuer as a group’. Accordingly, the Board is pleased to

provide the following statement that was prepared in accordance with the ‘Statement of Risk Management and Internal

Control: Guidelines for Directors of Listed Issuers’ as endorsed by Bursa Securities, which outlines the nature and scope

of risk management and internal control of the Group during the financial year under review.

Board’s Responsibility

The Board is responsible and accountable for

maintaining sound processes of risk management

and internal control practices to safeguard

shareholders’ investments and the Group’s

assets. Such processes cover not only financial

control but also operational and compliance

controls. In view of the limitations inherent in

any process, the risk management and internal

control processes and procedures put in place

can only manage risks within tolerable levels,

rather than eliminate the risk of failure to achieve

the Group’s business objectives.

The Board Audit Committee (BAC) assists

the Board in evaluating the adequacy of risk

management and internal control framework.

The BAC, via the Axiata Group Risk Management

Committee (GRMC), has put in place a systematic

risk management framework and process to

identify, evaluate and monitor principal risks; and

implement appropriate internal control processes

and procedures to manage these risks across the

Group, excluding Associate Companies and joint

ventures which are not within the Group’s control.

Following the written assurance from the

President and Group Chief Executive Officer

(GCEO) and Group Chief Financial Officer (GCFO),

that the Group’s risk management processes and

internal controls are operating effectively, the

Board is of the view that processes covering risk

management and internal control in place for the

year under review and up to the date of issuance

of the financial statements is sound and sufficient

to safeguard shareholders’ investments and the

Group’s assets.

Risk Management and Internal Control

Framework

1.

Axiata Enterprise Risk Management

Framework

The Group adopts the Axiata Enterprise

Risk Management (ERM) Framework

as a standardised approach for timely

identification, reporting andmanagement of

principal risks and ensures implementation,

tracking and review of effectiveness of

mitigation actions for the risks identified.

The framework, benchmarked against

ISO31000:2009, is adopted by all risk

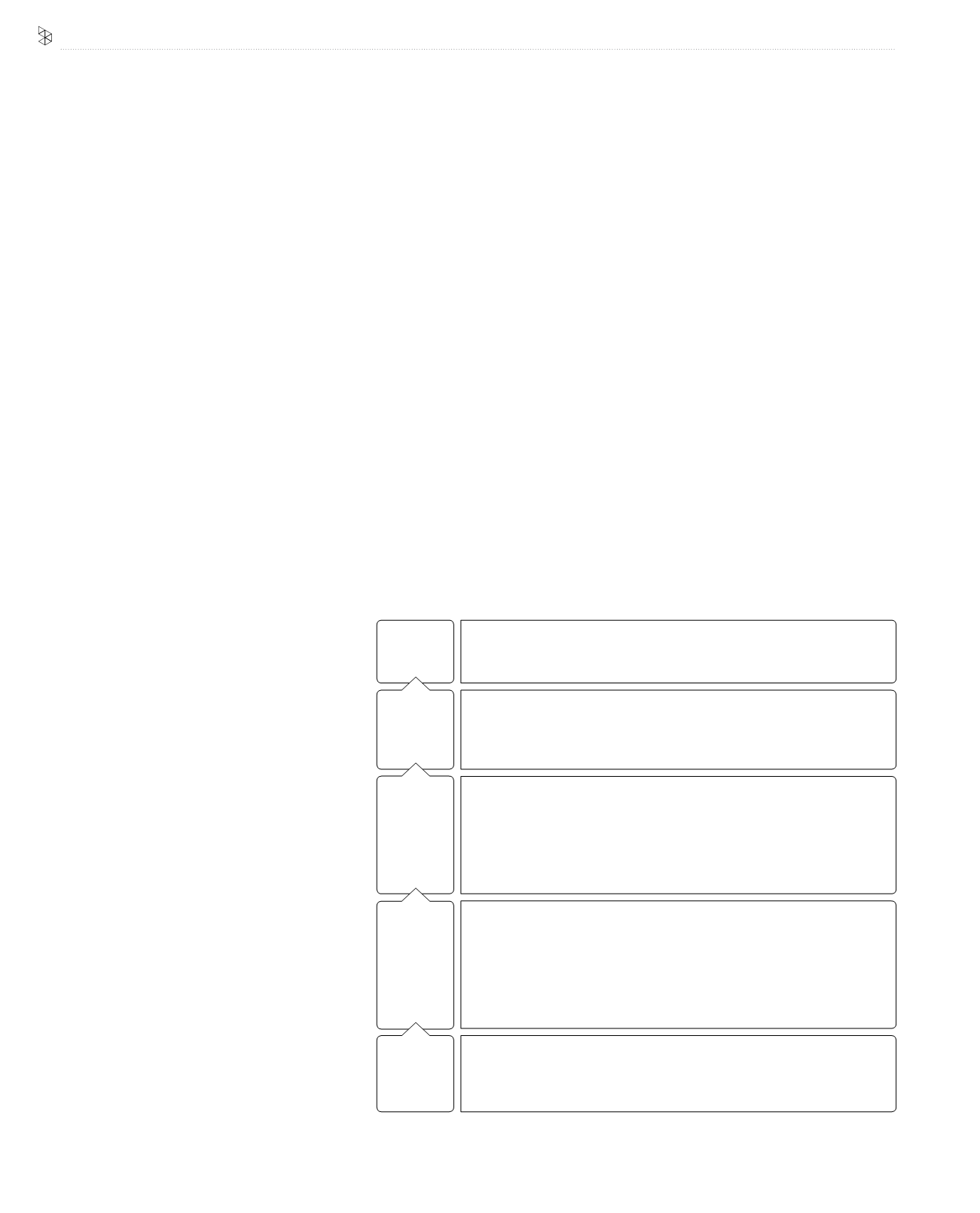

• Maintaining a sound system of risk management & internal controls

• Approves risk management policy and framework, governance structure and sets the

risk appetite

• Receives, deliberate and endorses BAC reports on risk governance and internal controls

• Assist the Board in evaluating the adequacy of risk management & internal control

framework

• Reviews and endorses the Group Risk Profile

• Receives and reviews reports from the Risk Committee and recommend them to the

Board for approval

Board Audit

Committee

• Assist in identifying principal risks at Group level and providing assurance that the ERM is

implemented group-wide

• Review and recommend frameworks and policies specifically to address enterprise risk

inherent in all business operations

• Promote cross-functional sharing of risk information

• Monitor compliance to ERM Framework, regulatory requirements and status of action

plans for both Group and subsidiaries

• Coordinate and promote risk management culture and implementation

• Establish, formulate, recommend and manage sound and best practice ERM program for

Axiata Group

• Inculcate risk awareness within the Group

• Assist Axiata OpCos and Business Units in establishing their internal risk policy and

structures, including business continuity programme for the Group

• Identification and consolidation of risk matters

• Secretariat for the GRMC

• Consolidated risk reports from Axiata OpCos and Business Units for the GRMC’s review

• Encourages & recommend the adoption of mitigation actions where appropriate

• Primarily responsible for managing risks on a day-to-day basis

• Promoting risk awareness within their operations and introduce risk management

objectives into their business and operations

• Coordinate with Axiata Group Risk Management Department on Implementation of risk

management policy and practices

management teams across the subsidiaries. It stresses the importance of balancing between risk

and reward in making strategic business decisions, a tool in managing both existing and potential

risks with the objective of protecting key stakeholders’ interests, and compliance with statutory

and legal requirements. At the same time, the framework promotes an effective risk culture whilst

embedding risk management in our daily business decisions.

2.

Risk Governance Structure

The Group is committed towards continuous improvement of risk management processes and

ensures that the processes remain relevant to the operating environment. The GRMC, which

consists of all the members of Axiata Group Senior Leadership Team (SLT) and chaired by the

Axiata Group BACChairman plays a key role in drivingAxiata’s ERMFramework. With the assistance

of the Group Risk Management Department (GRMD), they ensure systematic implementation and

monitoring of the effectiveness of risk management culture and processes across the Group.

The committee meets on a quarterly basis to review existing, new and evolving risks and where

necessary, evaluate effectiveness of mitigation plans and improve existing risk practises, where

necessary. The following depicts the key parties within the Group’s Risk Governance Structure and

their principal risk management roles and responsibilities:

Group Risk

Management

Committee

Group Risk

Management

Department

Risk Focals

at Axiata CC

and Opcos