Axiata Group Berhad | Annual Report 2016

MANAGEMENT DISCUSSION & ANALYSIS

036

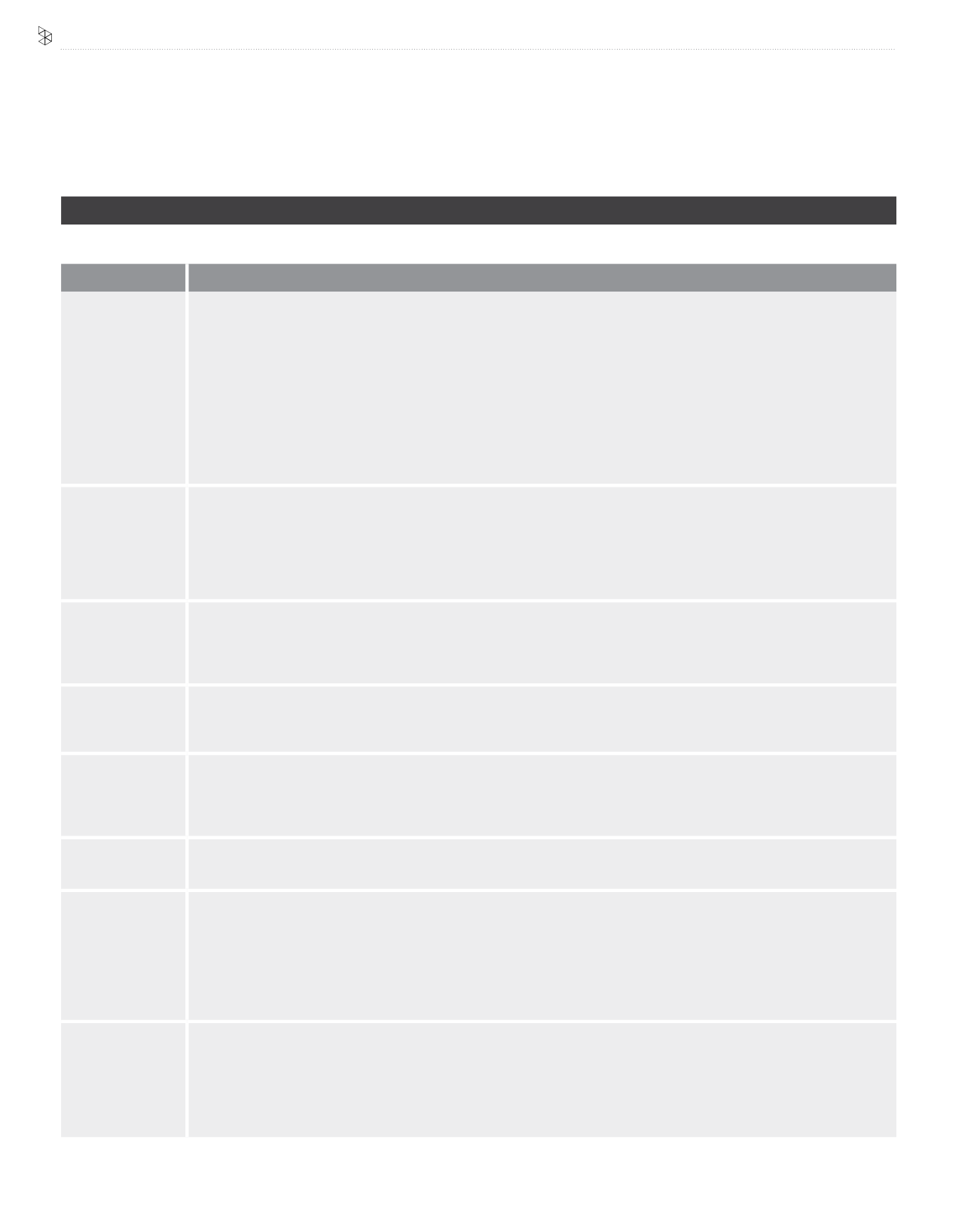

Strategy in 2017 Targets

Turnaround at

Celcom and XL

Axiata is banking on successful recovery at Celcom on the back of its refreshed management and turnaround strategy and will

be aggressive in recapturing its leadership position in certain areas in Malaysia in the coming year. In line with this, the Group has

allocated capex of RM1.4 billion (USD315 million) for Celcom for 2017, the majority of which will be used to improve its network

quality and coverage. This directed approach will enable Celcom to regain its momentum in the prepaid space, dealing with issues

such as pricing and packaging to regain its leadership position in 2017.

At XL there has been good traction amongst data savvy customers, with rising smartphone penetration and traffic denoting that

it is attracting the right customers. The plan is to expand beyond Jawa to growth areas in Sumatra, Kalimantan and Sulawesi which

is bound to contribute to an increase in revenue. To capture real growth in the middle segment of the market, XL will focus on

better deals, whilst refreshing the brand and team proposition. Within its vendor base, XL will be offering a different game plan to

appeal to its target market segment.

Investing in

the best data

network,

regaining data

and product

leadership

Axiata intends to be a clear number one player in 4G and achieve data leadership within selected areas in all of its markets of

operation. In line with this, the Group will be increasing capex from RM6.1 billion in 2016 to RM6.6 billion in 2017 to fund key

technology and network projects to achieve the best regional data network. By leveraging on collaborative opportunities

available in the marketplace, Axiata will lead the way in product leadership and innovation, especially of data-led products

and analytics in areas such as financial services, music, media and entertainment, digital advertising, Enterprise and Internet of

Things (IoT), and devices.

Continue

Strengthening our

South Asia Market

Following on from Robi’s merger in Bangladesh and the acquisition of Ncell in Nepal, the focus will be on effecting a quick

turnaround on consolidation and integration within these two OpCos and the Group, which will contribute to greater profitability in

2017. At Robi, the focus is to strengthen performance and improve market share by capitalising on synergies with Airtel, and the

Group has targeted double-digit revenue growth for the coming year.

Achieving

a Balanced

Portfolio

A key target slated for 2017 is to achieve a balanced portfolio by improving the Group's balance sheet and continuously reviewing

various strategic portfolio options to ensure long-term value enhancement, and optimal deployment of capital and funding for

growth strategies.

Cost Management

Strategy

Within the Group, Axiata has started implementing of a Group-wide Cost Management programme that will improve efficiency

and profitability within a better cost structure. Cost optimisation of RM800 million from operational expenditure and capex savings

has been built into the Group's 2017 plan. Axiata intends to achieve RM1.5 billion in additional savings in 2018 and 2019, channelling

the funds into its long-term business growth strategies.

Growth at edotco

edotco will be aggressively pursuing expansion opportunities within the region and intends to add at least two more tower

companies within the ASEAN and South Asia region to its portfolio of companies within the next one to two years.

Exploring New

Growth Areas

To maintain competitiveness within the evolving telco landscape, Axiata has identified four key growth pillars under the Axiata

3.0 strategy:

• Convergent Networks and Infrastructure to deliver dedicated services into the home via the most efficient technology

• Enterprise and IoT through Business to Business (B2B) and Business to Business to Consumer (B2B2C) solutions across multiple

industries

• Financial Services (Fintech) such as insurance and micro/nano-credit

• Media, Entertainment and Advertising via go-to-market partnerships and investments through Axiata Digital

Investing in

Digitisation

In staying ahead of the curve and capitalising on the benefits of digitisation, Axiata will be focusing on some key initiatives in 2017:

• Commencing a structured Digitisation benchmarking against global and regional peers

• Setting and measuring Key Performance Indicators (KPIs) to achieve digitisation across the business at both Group and OpCo

levels

• Customer facing digitisation efforts such as self-care digital application and dealer registration digital application roll outs

• Digital and social media platform marketing, analytics and customer engagement

2017 OUTLOOK

For complete details on outlook for each market, please refer to pages 38 to 50 of this Annual Report.

GROUP OUTLOOK FOR 2017

For 2017, Axiata has strategised a number of initiatives and targets in line with its ambition of becoming a New Generation Digital Champion by 2020.