Axiata Group Berhad | Annual Report 2016

MANAGEMENT DISCUSSION & ANALYSIS

032

PRUDENT AND DISCIPLINED DIVIDEND PAYOUT

Axiata declared a 8 sen per share single tier dividend (including interim dividend of 5 sen per share paid last year), implying a DPR of 50%. The Board’s

decision to declare a conservative 50% DPR takes into account the following:

i)

Cautionary, prudent measure to ensure resilience against:

a) unpredictable forex and market volatility; and

b) further spectrum costs in the next two years

ii) Investment for strategic long-term benefits:

a) Increased capex investment where Axiata intends to be a clear number one player in 4G and data leadership in selected areas in all markets; and

b) Market consolidation and edotco’s expansion.

This decision is for the short-term and the DPR is expected to be at 2015 level within two years, as management remains committed to sustain positive

performance with financial discipline, efficient cash management and prudent investments, and growth strategies moving forward.

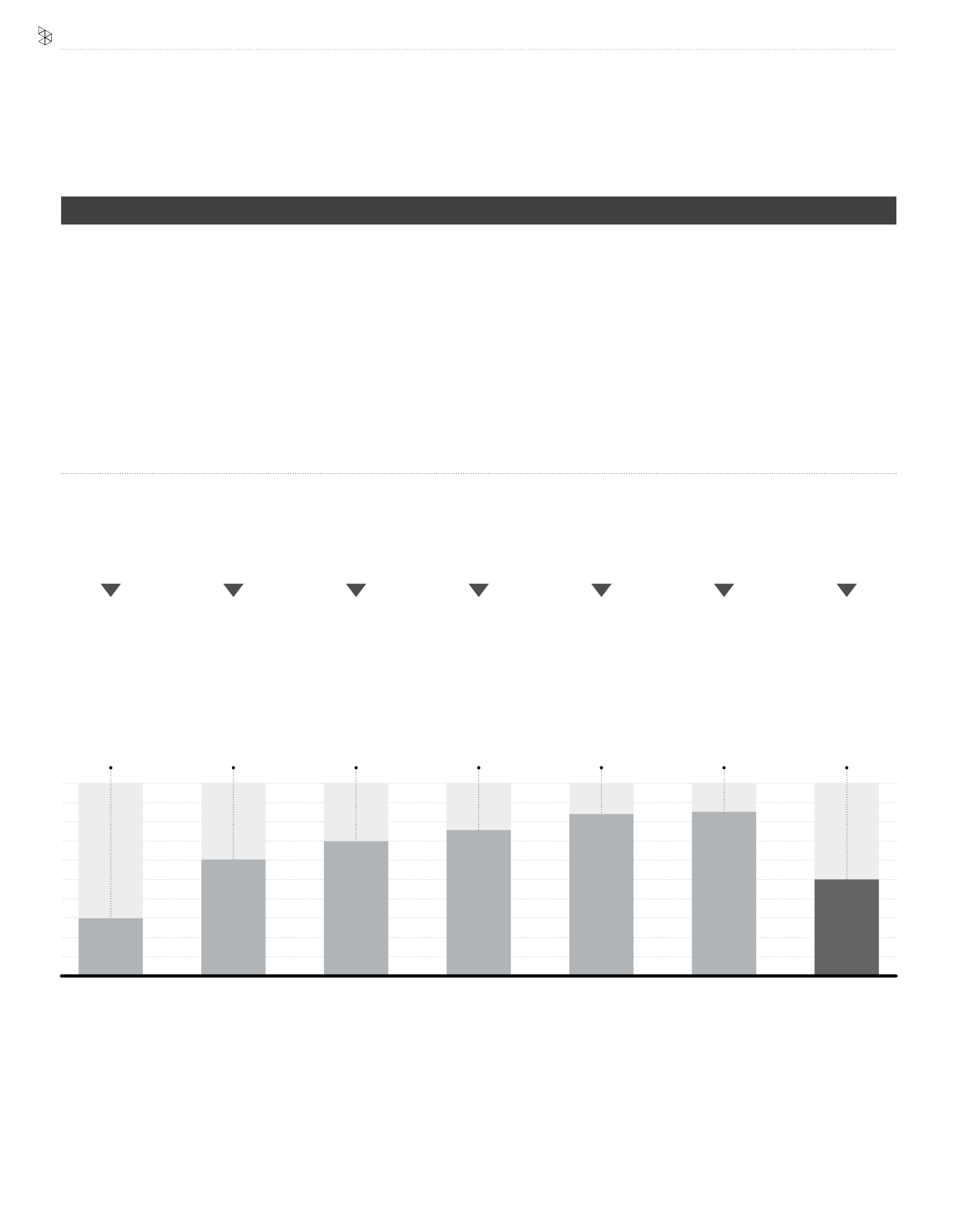

2010

2011

2012

2013

2014

2015

2016

Inaugural dividend

announcement

Dividend Yield = 2.1%

Total Dividend =

RM0.9bn

DPS = 10 sen

Dividend Yield = 3.9%

Total Dividend =

RM1.5bn

DPS = 19 sen

Dividend Yield = 3.3%

Total Dividend =

RM1.9bn

DPS = 22 sen

Dividend Yield = 3.2%

Total Dividend =

RM1.9bn

DPS = 22 sen

Dividend Yield = 3.1%

Total Dividend =

RM1.8bn

DPS = 20 sen

Dividend Yield = 1.5%

Total Dividend =

RM0.7bn

DPS = 8 sen

Dividend Yield = 5.5%

Ordinary Dividend =

RM1.9bn

Ordinary DPS = 23 sen

Special Dividend =

RM1.0bn

Special DPS = 12 sen

Total DPS = 35 sen

Step increase

in DPR with the

growth in Group

Net FCF

One-off Special

Dividend, on

top of increased

ordinary DPR

Increase in DPR,

in line with

progressive

dividend policy

Increase in DPR,

in line with

progressive

dividend policy

Increase in DPR,

in line with

progressive

dividend policy

Decrease in DPR

for prudent and

strategic reasons

30%

DPR

1

60%

70%

75%

84%

85%

50%

¹ DPR - Dividend payout ratio

2

DPS - Dividend per share

2016 IN REVIEW: KPI, INVESTMENT PERFORMANCE & PRUDENT AND DISCIPLINED

DIVIDEND PAYOUT