Axiata Group Berhad | Annual Report 2016

OPERATING COMPANIES BUSINESS REVIEW

042

Security and Home Automation. Dialog intends

to capitalise on IoT opportunities available to

further augment its profitability.

Key Highlights

• Subscriber growth of 19.5% to 33.8

million

• Data revenue growth of 38.9%

• Post-merger operating as “Robi

Axiata Limited”

• World’s # 1 Socially Devoted

Brand by ‘Socialbakers’

• GSMA Glomo Awards for Best

Mobile Innovation for Education

and Learning

About Robi

Robi Axiata Limited is a joint venture of Axiata

Group Berhad of Malaysia, Bharti Airtel Limited

of India (Bharti) and NTT DoCoMo Inc. of Japan

(NTT DoCoMo). The entity ‘Robi Axiata Limited’

merged with Bharti’s operation in Bangladesh,

‘Airtel Bangladesh Limited’, in November 2016 to

form the new entity where Axiata holds 68.7%

controlling stake, Bharti 25% while the remaining

6.3% is held by NTT DoCoMo.

The merged entity is the second largest

mobile operator in Bangladesh with 33.8 million

active subscribers. It provides the country’s

widest network coverage, covering 99% of the

population with 9,295 2G and 5,192 3.5G sites.

Robi is the first operator to introduce GPRS

and 3.5G services in Bangladesh. The Company

has introduced many first of its kind digital

services in the country and has invested

heavily in providing mobile financial services

to underserved communities in rural and semi-

urban areas.

Business Review 2016

2016 proved to be a challenging year for the

telco industry in Bangladesh, primarily due to

regulatory impacts from required compliance for

SIM biometric re-registration. The requirement

caused a drop off in new subscriber activations,

and subscriber growth was sluggish as a result.

The situation was further complicated by the

regulator deactivating unregistered biometric

non-compliant SIMs.

Despite these challenging circumstances, Robi’s

subscriber base increased by 19.5% to 33.8

million post-merger, representing 26.9% of

industry subscriber market share, effectively

cementing its position as the second largest

operator in Bangladesh.

Total revenue grew marginally by 0.5%

compared to the previous year, while data

revenue registered strong growth of 38.9%. Data

revenue growth was propelled by significant

network investments to the tune of BDT20.3

billion, coupled with innovative affordable data

offerings to drive 3.5G and 2.5G data use.

The Company continued investing aggressively

in fast-tracking its 3.5G network expansion

and improving 2.5G network quality for better

customer experience both in voice and data

services. Total capex investment made by Robi

since inception amounted to BDT182.6 billion.

Robi now has network coverage in all 64 districts

in Bangladesh with 9,295 2G and 5,192 3.5G sites.

Throughout the year, Robi continued with its

innovative and affordable product offerings in

the market. Among them were special offerings

to capture greater market share capitalising on

the public interest over the Robi-Bharti merger

such as the ‘Merger Bonanza Offer’ launched

on the eve of the merger. The Company also

expanded the Airtel-Yonder Music app offering

to subscribers of the Airtel brand.

With the successful completion of the final phase

of the merger in the fourth quarter of 2016, Robi

has been focusing on creating the number one

network which will deliver the widest mobile

network coverage and superior mobile services

experience to its subscribers.

Financial Performance

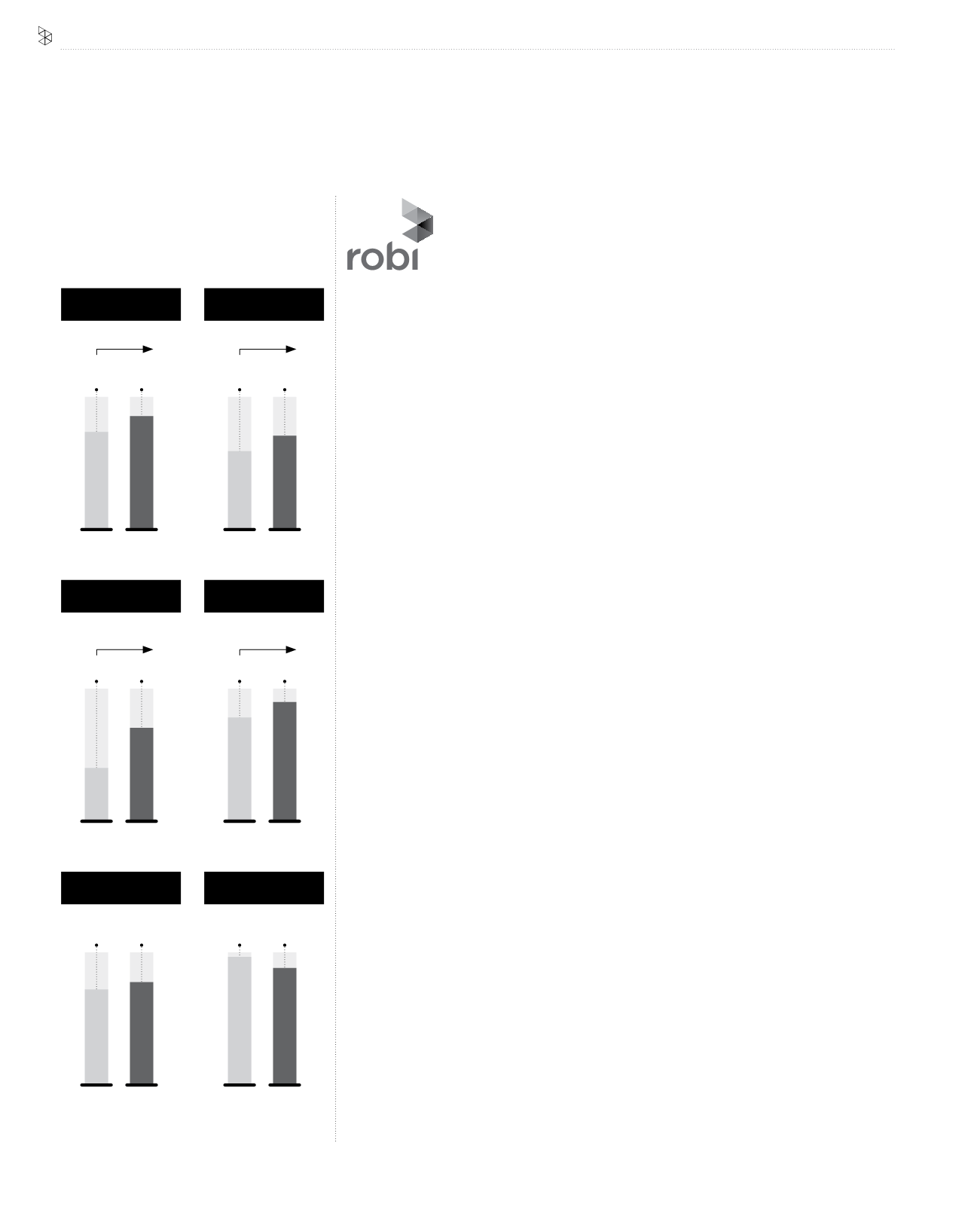

In 2016, Robi registered total revenue growth of

0.5% while data revenue grew significantly by

38.9%. Data revenue growth was due to focused

investments in network as well as innovative

affordable data offerings to drive 3.5G and 2.5G

data usage.

The Company registered fourth quarter Quarter

on Quarter (QoQ) revenue growth of 5.0%,

which includes 1.5 months of Airtel revenue and

solid growth within the data business segment.

PAT

5,188

9,041

2015 2016

SUBSCRIBERS

10.9

11.8

2015 2016

+9%

74%

(+33% normalised*)

SLR Million

Million

REVENUE

73,930

86,745

2015 2016

+17%

+23%

EBITDA & EBITDA

MARGIN (%)

32%

34%

23,824

29,212

2015 2016

SLR Million

SLR Million

Dialog

BUSINESS REVIEW

BLENDED ARPU

362

396

2015 2016

BLENDED MoU

(Per Sub Per Month)

145

133

2015 2016

SLR

Minutes of use/sub/month

* Normalised for forex losses