FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

187

14. EMPLOYEE SHARE OPTION AND SHARE SCHEME (CONTINUED)

(a) Performance-Based Employee Share Option Scheme and Restricted Share Plan [“Axiata Share Scheme”] (continued)

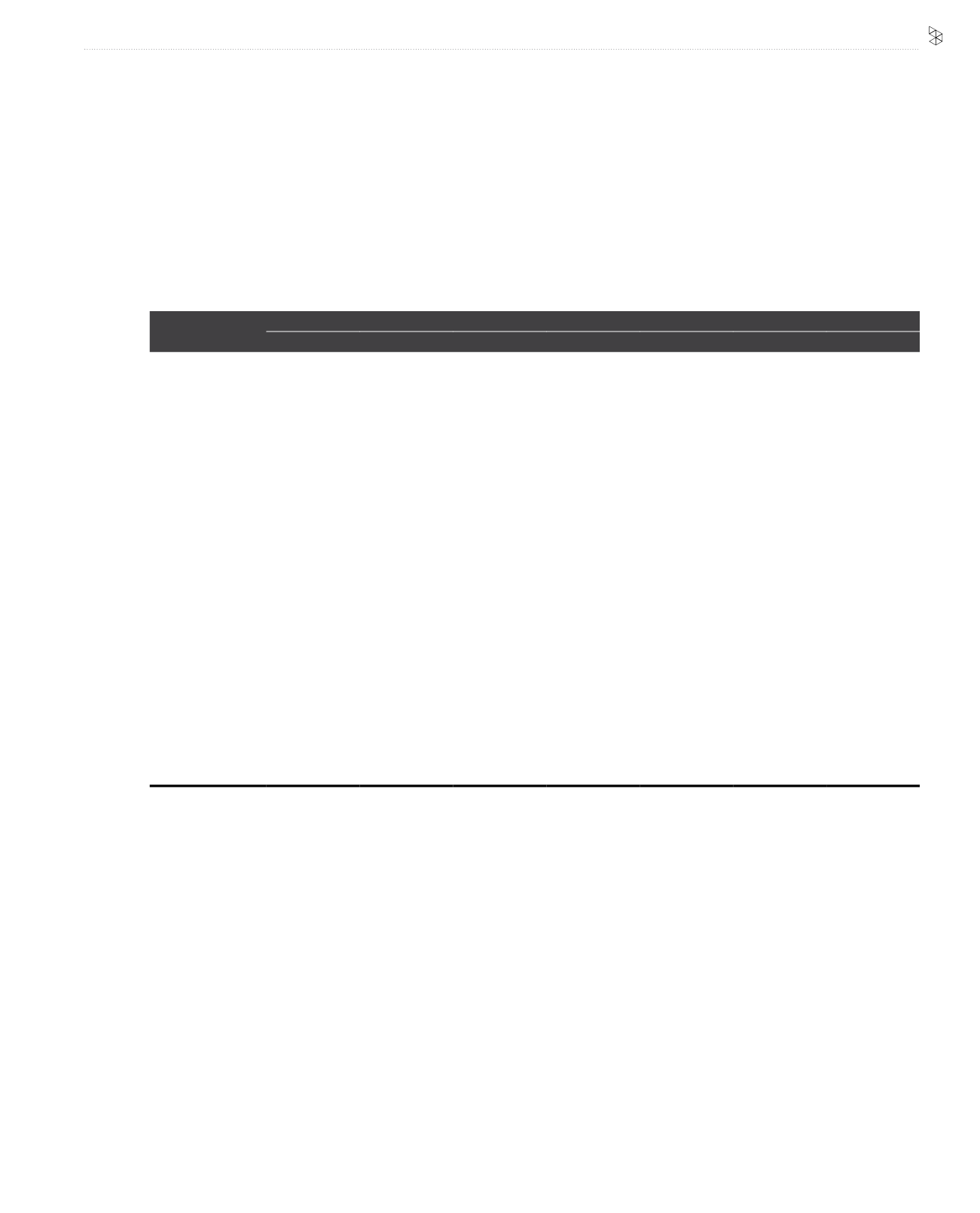

The fair value of the RSA granted in which MFRS 2 applies, were determined using the Monte Carlo valuation model. The significant inputs in

the model are as follows: (continued)

Entitlement over the Company's shares

Grant 5(a)

Grant 5(b)

Grant 6(a)

Grant 6(b)

Grant 7(a)

Grant 7(b)

Grant 8

Reference price

RM6.27

RM6.90

RM6.55

RM6.95

RM7.11

RM5.92

RM5.68

Valuation at grant

date*

29 Mar 2013 15 Aug 2013 07 Apr 2014 02 Sep 2014 09 Apr 2015 17 Sep 2015 14 Apr 2016

Vesting date:

- Tranche 1

20 Feb 2015 15 Aug 2015 15 Feb 2016 15 Aug 2016

-

-

-

- Tranche 2

20 Feb 2016 15 Aug 2016 15 Feb 2017 15 Aug 2017 15 Feb 2018 15 Aug 2018 15 Feb 2019

Closing share price

at grant date*

RM6.60

RM6.90

RM6.69

RM6.94

RM7.06

RM6.29

RM5.88

Expected dividend

yield

4.58%

4.20%

3.79%

3.89%

3.96%

3.96%

4.08%

Risk free interest

rates

(Yield of Malaysian

Government

Securities)

2.88% - 3.09% 3.17% - 3.36% 3.00% - 3.38%

3.46%

3.57%

3.76%

3.22%

Expected volatility

#

18.7%

17.4%

16.5%

15.8%

14.26%

15.20%

16.1%

#

The expected volatility rate of the Company's RSA was derived using three (3) years period on daily basis historical volatility due to

availability of data with more data points to increase the credibility of assumptions.

*

Grant date refers to the date where majority of employees accepted the offer.