FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

193

16. BORROWINGS (CONTINUED)

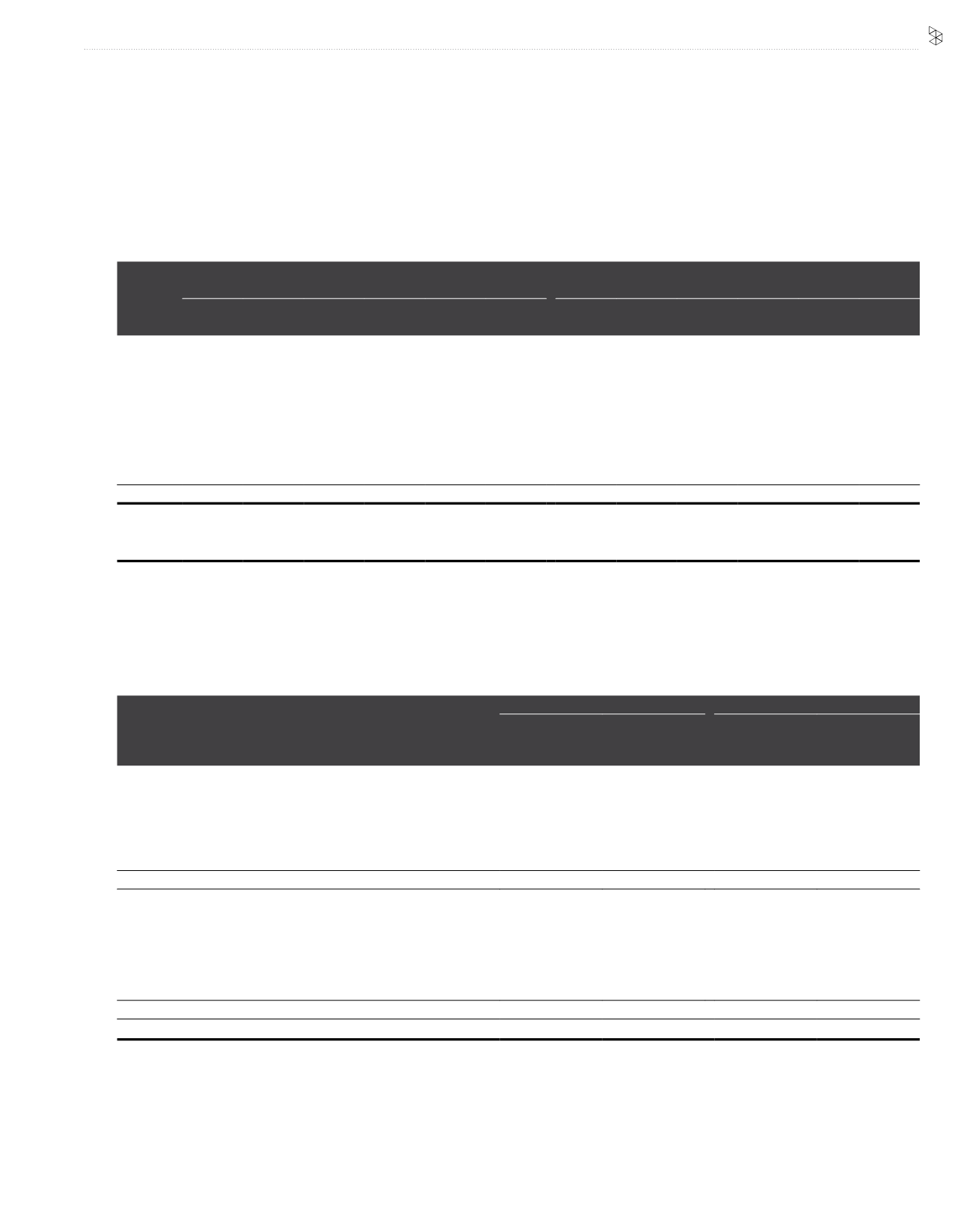

The currency profile of the borrowings of the Group is as follows:

2016

Functional currency

2015

Functional currency

RM

RM’000

IDR

RM’000

SLR

RM’000

BDT

RM’000

Others

RM’000

Total

RM’000

RM

RM’000

IDR

RM’000

SLR

RM’000

BDT

RM’000

Others

RM’000

Total

RM’000

Group

RM

5,035,432

-

-

-

- 5,035,432

4,526,427

-

-

-

- 4,526,427

USD

9,228,322 1,608,958 675,140 672,168 67,194 12,251,782

3,689,447 1,942,656 637,810 384,545 231,806 6,886,264

IDR

- 3,372,189

-

-

- 3,372,189

- 4,411,853

-

-

- 4,411,853

SLR

-

-

353,555

-

-

353,555

-

-

78,349

-

-

78,349

BDT

-

-

- 1,193,680

- 1,193,680

-

-

-

439,888

-

439,888

PKR

-

-

-

-

53,243 53,243

-

-

-

-

49,605 49,605

Total

14,263,754 4,981,147 1,028,695 1,865,848 120,437 22,259,881

8,215,874 6,354,509 716,159 824,433 281,411 16,392,386

Company

USD

2,968,244

-

-

-

- 2,968,244

-

-

-

-

-

-

USD: United State Dollars

IDR: Indonesian Rupiah

SLR: Sri Lankan Rupee

BDT: Bangladeshi Taka

PKR: Pakistani Rupee

The carrying amounts and fair value of the Group’s non-current borrowings are as follows:

2016

2015

Carrying

amount

RM’000

Fair value

RM’000

Carrying

amount

RM’000

Fair value

RM’000

Group

Overseas:

- Borrowings

2

4,772,535

4,772,535

5,849,767

5,849,767

- Sukuk Ijarah

3

334,998

371,148

312,866

494,372

5,107,533

5,143,683

6,162,633

6,344,139

Malaysia:

- Notes

3

1,337,866

1,444,407

1,277,922

1,411,956

- Multi-currency Sukuk

3

4,470,565

4,534,516

2,104,101

2,146,236

- Sukuk Murabahah

2

3,972,470

3,949,362

4,500,000

4,434,946

- Borrowings

2

247,038

247,038

-

-

10,027,939

10,175,323

7,882,023

7,993,138

15,135,472

15,319,006

14,044,656

14,337,277

2

The fair values are calculated based on cash flows discounted using a rate based on the borrowing rate which ranges from 1.10% to 12.10%

(2015: 1.10%% to 11.25% ) p.a. and are within level 2 of the fair value hierarchy.

3

The fair value is based on quoted price in an active market and is within level 1 of the fair value hierarchy.

The fair value of current borrowings approximates their carrying amount, as the impact of discounting is not significant.