Axiata Group Berhad | Annual Report 2016

FINANCIAL STATEMENTS

198

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2016

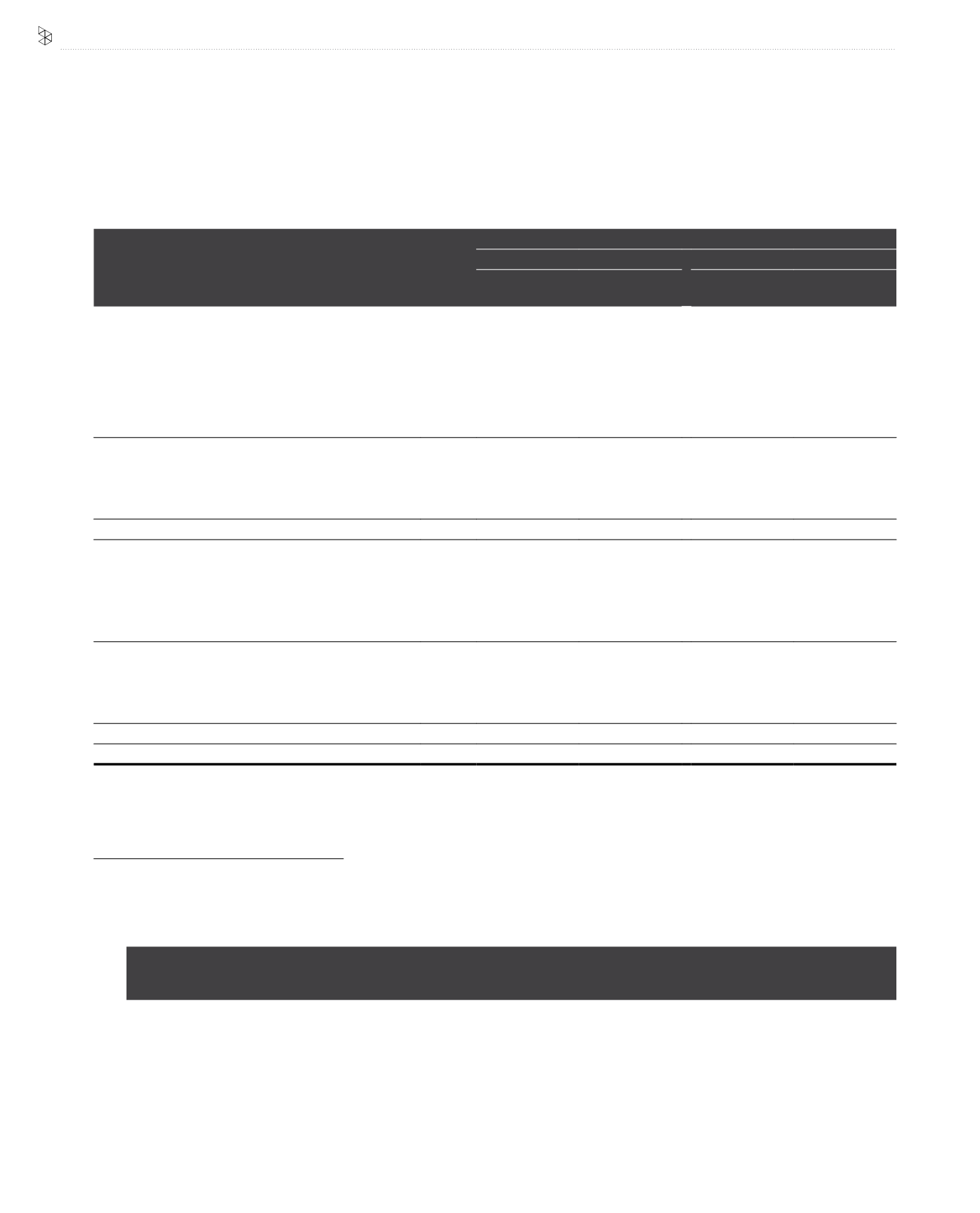

19. DERIVATIVE FINANCIAL INSTRUMENTS

Note

Group

2016

2015

Assets

RM’000

Liabilities

RM’000

Assets

RM’000

Liabilities

RM’000

Non-current

Non-hedging derivative financial instruments:

- CCIRS

(a)

61,567

-

72,330

-

- Call spread options

(b)

107,867

-

46,751

-

- Convertible warrants in an associate

(c)

8,343

-

8,343

-

- Put option over shares held by NCI

(d)

-

(1,165,420)

-

-

177,777

(1,165,420)

127,424

-

Derivative designated as hedging instruments:

- CCIRS

(f),(g)

220,541

-

101,807

-

- IRS

(h)

-

(437)

-

(743)

Total non-current

398,318

(1,165,857)

229,231

(743)

Current

Non-hedging derivative financial instruments:

- CCIRS

(a)

-

-

113,251

-

- Put option over shares held by NCI

(e)

-

(157,010)

-

(172,753)

-

(157,010)

113,251

(172,753)

Derivative designated as hedging instruments:

- IRS

(h)

-

(465)

-

(359)

- CCIRS

(f)

2,735

(5,175)

-

-

Total current

2,735

(162,650)

113,251

(173,112)

Total

401,053

(1,328,507)

342,482

(173,855)

Non-hedging derivatives are classified as current/non-current assets or liabilities. The full fair value of a hedging derivative is classified as a non-

current asset or liability if the remaining maturity of the hedged item is more than twelve (12) months and, as a current asset or liability, if the

maturity of the hedged items is less than twelve (12) months.

Non-hedging derivatives financial instruments

(a) Cross currency interest rate swaps

The information relating to the derivative financial instruments of a subsidiary of the Group as at 31 December 2016 is as follows:

Counterparties

Notional

amount

USD’ million

Period

Swap

amount

IDR’ billion

Exchange

period

Fixed

interest

rate paid

Exchange

rate per

1USD:

Interest

rate received

Standard Chartered

Bank

50.0 13 June 2013 -

13 June 2018

495.9

Quarterly

7.60% IDR9,918

Fixed rate

2.3%