FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

185

14. EMPLOYEE SHARE OPTION AND SHARE SCHEME (CONTINUED)

(a) Performance-Based Employee Share Option Scheme and Restricted Share Plan [“Axiata Share Scheme”] (continued)

The fair value of the Performance-based ESOS granted in which MFRS 2 applies, were determined using the Black-Scholes valuation model.

The significant inputs in the model are as follows:

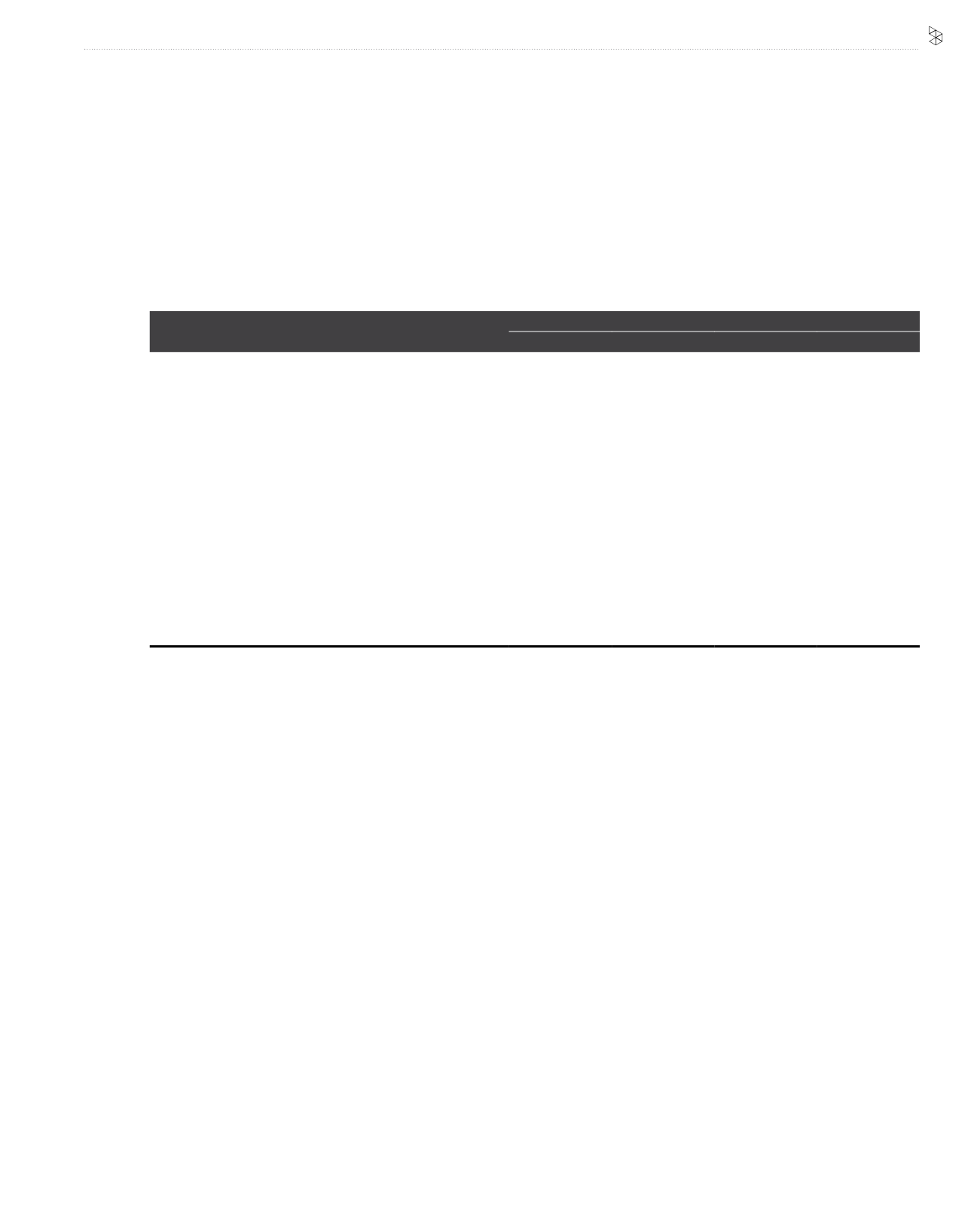

Options over the Company's shares

Grant 1(a)

Grant 1(b)

Grant 2

Grant 3(a)

Exercise price

RM1.81

RM3.15

RM3.45

RM5.07

Option expected term:

- Tranche 1

5.0 years

4.5 years

4.5 years

4.0 years

- Tranche 2

5.5 years

5.0 years

5.0 years

4.5 years

Weighted average share price at grant date

RM1.81

RM3.15

RM3.45

RM5.07

Expected dividend yield

1%

1%

1%

2%

Risk free interest rates

(Yield of Malaysian Government securities)

3.0% - 3.7% 3.0% - 3.7% 3.0% - 3.9% 3.3% - 3.6%

Expected volatility

31.3%

8

31.1%

8

34.4%

24.7%

8

The expected volatility rate of the Company’s options was derived after considering the pattern and level of historical volatility of

entities in the same industry since the Company did not have sufficient information on historical volatility as it was only listed on the

Bursa Securities on 28 April 2008.