MANAGEMENT DISCUSSION & ANALYSIS

Axiata Group Berhad | Annual Report 2016

023

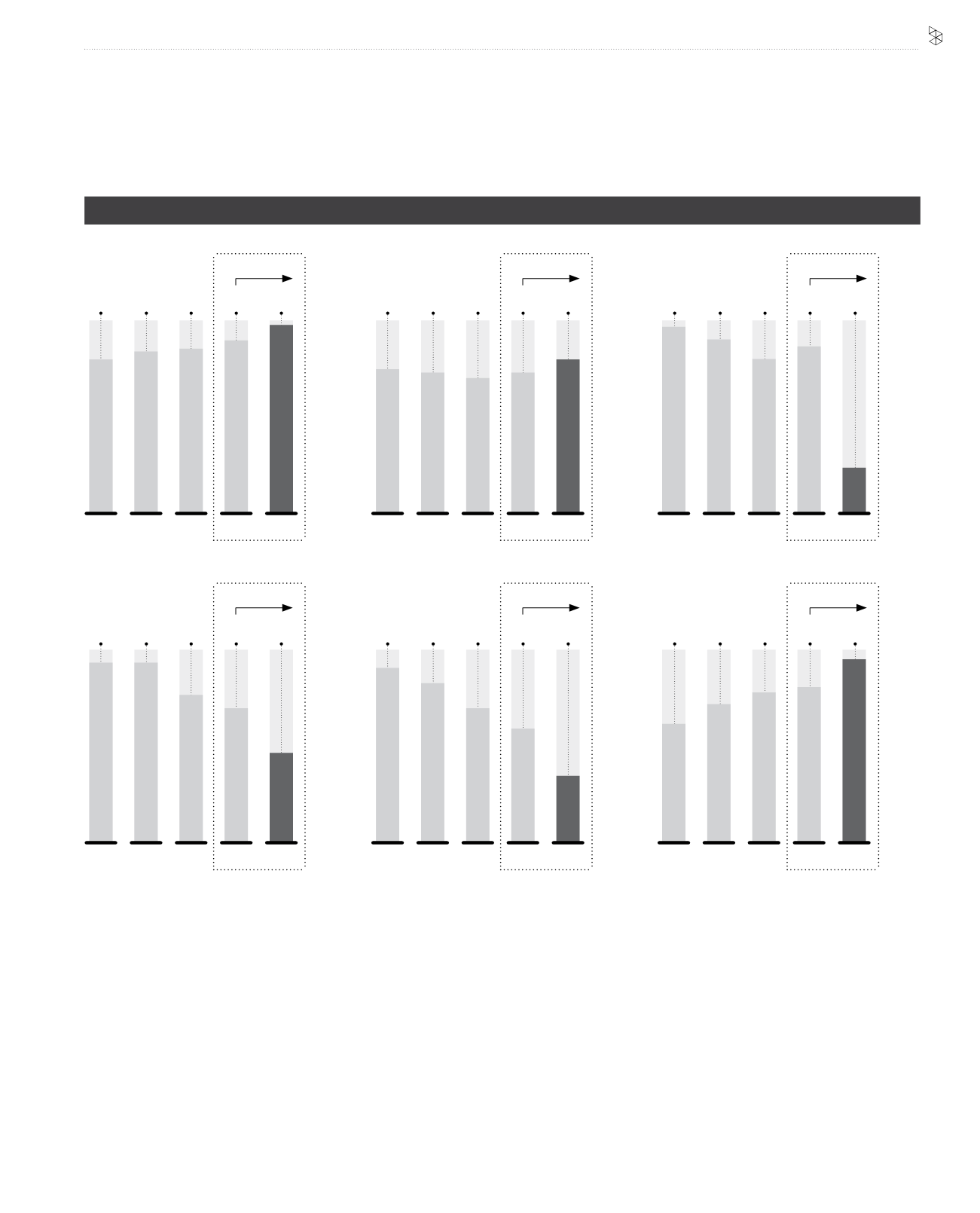

PAT

(RM Billion)

Normalised PATAMI*

(RM Billion)

EBITDA

(RM Billion)

ROIC

(%)

Subscribers

(Million)

Operating Revenue

(RM Billion)

18.7 19.9

21.6

18.4

17.7

7.0 7.3

8.0

7.3

7.4

2.4 2.6

0.7

2.7

2.9

Note 1 - 2012 normalised PATAMI excludes Celcom tax incentive (-RM110.0 million), Celcom Sukuk related costs (+RM26.3 million), Celcom network

impairment (+RM161.6 million), Dialog tax impact (-RM47.8 million), Hello asset impairment (+RM46.0 million), Robi SIM tax (+RM34.4 million) and foreign

exchange loss (+RM161.3 million).

Note 2 - 2013 normalised PATAMI excludes Celcom tax incentive (-RM106.0 million), Celcom network impairment (+RM67.5 million), Robi physical count

loss and impairment on receivables (+RM16.7 million), Smart asset write-off (+RM31.4 million) and foreign exchange loss (+RM201.3 million).

Note 3 - 2014 normalised PATAMI excludes gain on disposal of Samart i-Mobile (-RM116.7 million), XL gain on disposal of towers (-RM48.2 million) and

foreign exchange loss (+RM55.5 million).

Note 4 - 2015 normalised PATAMI excludes XL gain on disposal of towers (-RM399.8 million), Sri Lanka tax impact (+RM49.0 million) and foreign

exchange gain (-RM132.3 million).

Note 5 - 2016 normalised PATAMI excludes XL gain on disposal of towers (-RM339.6 million), XL accelerated depreciation (+RM193.3 million), Ncell

purchase price allocations (+RM105.5 million), Robi accelerated depreciation (+RM110.5 million), Robi-Airtel merger one-off adjustments (+RM20.2

million) and foreign exchange loss (+RM824.1 million).

* On normalised PATAMI, derivative gains/losses were not normalised prior to 2014. Derivatives losses in FY14 was RM22.5 million, gains in 2015 was

RM49.5 million while loss in 2016 was RM77.1 million.

2.3 2.1

1.4

2.8

2.8

9.0 7.7

4.5

10.7

11.8

266 275

320

244

205

2014

2014

3

2014

2014

2014

2014

2015

2015

4

2015

2015

2015

2015

2013

2013

2

2013

2013

2013

2013

2012

2012

1

2012

2012

2012

2012

2016

2016

5

2016

2016

2016

2016

+8%

-32%

+10%

-3.2pp

-75%

+16.4%

GROUP FINANCIAL HIGHLIGHTS