Axiata Group Berhad | Annual Report 2016

FINANCIAL STATEMENTS

236

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2016

39. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONTINUED)

(e) Fair value estimation (continued)

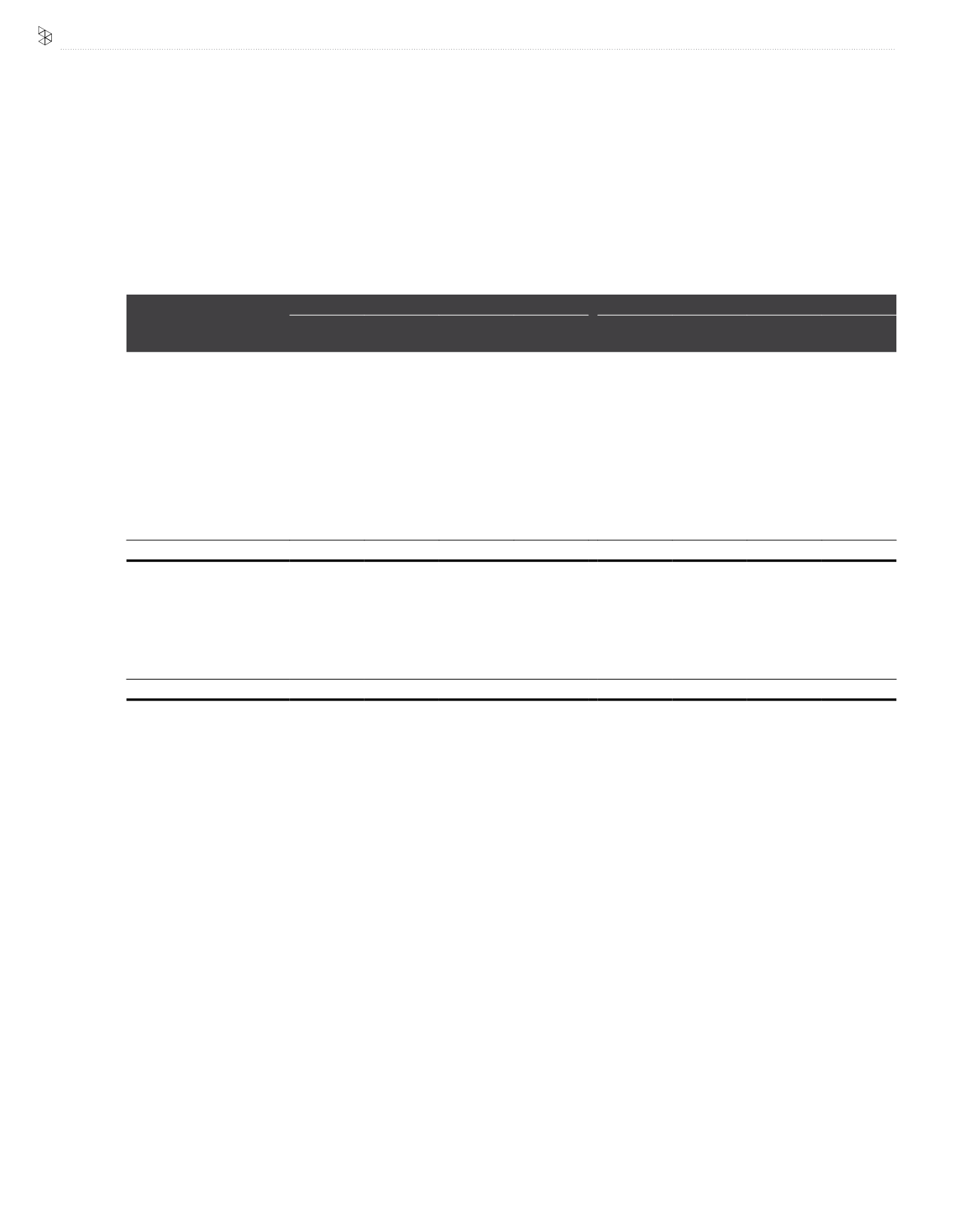

The following table represents the fair value level of the financial assets and liabilities that are measured at fair value as at reporting date.

2016

2015

Level 1

RM’000

Level 2

RM’000

Level 3

RM’000

Total

RM’000

Level 1

RM’000

Level 2

RM’000

Level 3

RM’000

Total

RM’000

Group

Assets

Financial assets at FVTPL:

- Trading securities

18

-

-

18

28

-

-

28

- Non-hedging derivatives

-

177,777

-

177,777

-

240,675

-

240,675

- Derivatives used for

hedging

-

223,276

-

223,276

-

101,807

-

101,807

Financial assets at AFS:

- Equity securities

-

62,675

1,250

63,925

-

-

31,286

31,286

Total assets

18 463,728

1,250 464,996

28 342,482

31,286 373,796

Liabilities

Financial liabilities at FVTPL:

- Non-hedging derivatives

- (1,322,430)

- (1,322,430)

-

(172,753)

-

(172,753)

- Derivatives used for

hedging

-

(6,077)

-

(6,077)

-

(1,102)

-

(1,102)

Total liabilities

- (1,328,507)

- (1,328,507)

-

(173,855)

-

(173,855)

(i) Financial instruments in level 1

The fair value of financial instruments traded in active markets is based on quoted market prices at the reporting date. A market is

regarded as active if quoted prices are readily and regularly available from an exchange, dealer, broker, industry group, pricing service,

or regulatory agency, and those prices represent actual and regularly occurring market transactions on an arm’s length basis.

(ii) Financial instruments in level 2

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives) is determined

by using valuation techniques. These valuation techniques maximise the use of observable market data where it is available and rely as

little as possible on entity specific estimates. If all significant inputs required to fair value an instrument are observable, the instrument is

included in level 2.

If one or more of the significant inputs is not based on observable market data, the instrument is included in Level 3.

Specific valuation techniques used to value financial instruments include:

•

Quoted market prices or dealer quotes for similar instruments;

•

The fair value of cross currency interest rate swaps and interest rate swaps is calculated as the present value of the estimated

future cash flows based on observable market curves; and

•

The fair value of forward foreign exchange contracts is determined using forward exchange rates at the reporting date, with the

resulting value discounted back to present value.

(iii) Financial instruments in level 3

The movement of the financial instruments in level 3 has no material impact to the results of the consolidated financial statements.