FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

231

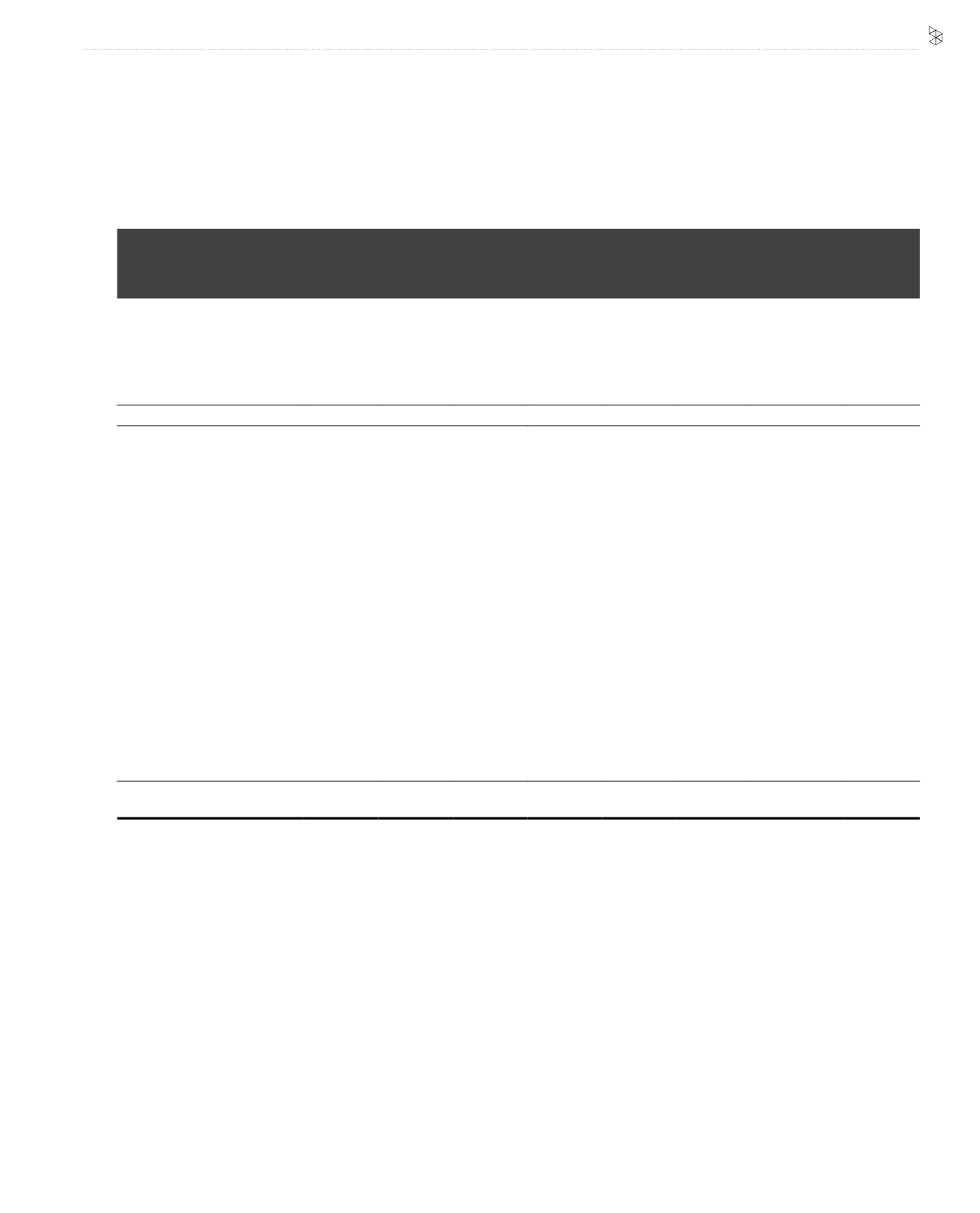

38. SEGMENTAL REPORTING (CONTINUED)

Malaysia

RM’000

Indonesia

RM’000

Bangladesh

RM’000

Sri Lanka

RM’000

Cambodia

RM’000

Others

#

RM’000

Consolidation

adjustments/

eliminations

RM’000

Total

RM’000

Financial year ended

31 December 2015

Operating revenue:

Total operating revenue

7,337,574 6,656,969 2,622,987 2,120,731 907,419 848,953

- 20,494,633

Inter-segment*

(7,397)

(37,003)

(143)

(38,896)

(17)

(527,717)

-

(611,173)

External operating revenue

7,330,177 6,619,966 2,622,844 2,081,835 907,402 321,236

- 19,883,460

Results:

EBITDA

2,719,163 2,512,587 944,179 684,315 450,746

2,085

(29,021) 7,284,054

Finance income

98,666

55,645

7,343

13,920

6,932 147,575

(156,660)

173,421

Finance expense

(194,687)

(540,526)

(37,182)

(23,886)

(7,993)

(175,902)

149,038 (831,138)

Depreciation of PPE

(758,748) (2,101,158)

(433,521)

(377,993)

(160,244)

(88,884)

42,491 (3,878,057)

Amortisation of intangible assets (56,492)

(71,549)

(116,667)

(30,684)

(4,287)

(845)

(11,174)

(291,698)

Joint ventures:

- share of results (net of tax)

6,693

(42,782)

-

-

-

(2,498)

-

(38,587)

Associates:

- share of results (net of tax)

(35,494)

-

-

(943)

-

525,943

-

489,506

- loss on dilution of equity

interests

-

-

-

-

-

-

(17,356)

(17,356)

Impairment of PPE (net of

reversal)

-

(14,604)

3,745

6,182

-

(1,168)

-

(5,845)

Other non-cash income/

(expenses)

(3,109)

15,345

(1,655)

(77,318)

(2,499)

508,461

7,617 446,842

Taxation

(474,681)

176,110 (165,804)

(95,012)

(62,205)

(59,945)

(13,537)

(695,074)

Segment profit for the financial

year

1,301,311

(10,932)

200,438

98,581 220,450 854,822

(28,602) 2,636,068

#

Share of associates' results contributed by Idea Cellular Limited (RM368.8 million) and M1 Limited (RM157.8 million).

39. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

(a) Market risks consist of:

(i)

foreign currency exchange risk – risk that the value of a financial instrument will fluctuate due to changes in foreign exchange rates.

(ii) fair value interest rate risk – risk that the value of a financial instrument will fluctuate due to changes in market interest rates.

(iii) cash flow interest rate risk – risk that future cash flows associated with a financial instrument will fluctuate. In the case of a floating

rate debt instrument, such fluctuations result in a change in the effective interest rate of the financial instrument, usually without a

corresponding change in its fair value.

(iv) price risk – risk that the value of a financial instrument will fluctuate as a result of changes in market prices, whether those changes are

caused by factors specific to the individual instrument or its issuer or factors affecting all instrument traded in the market.