FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

223

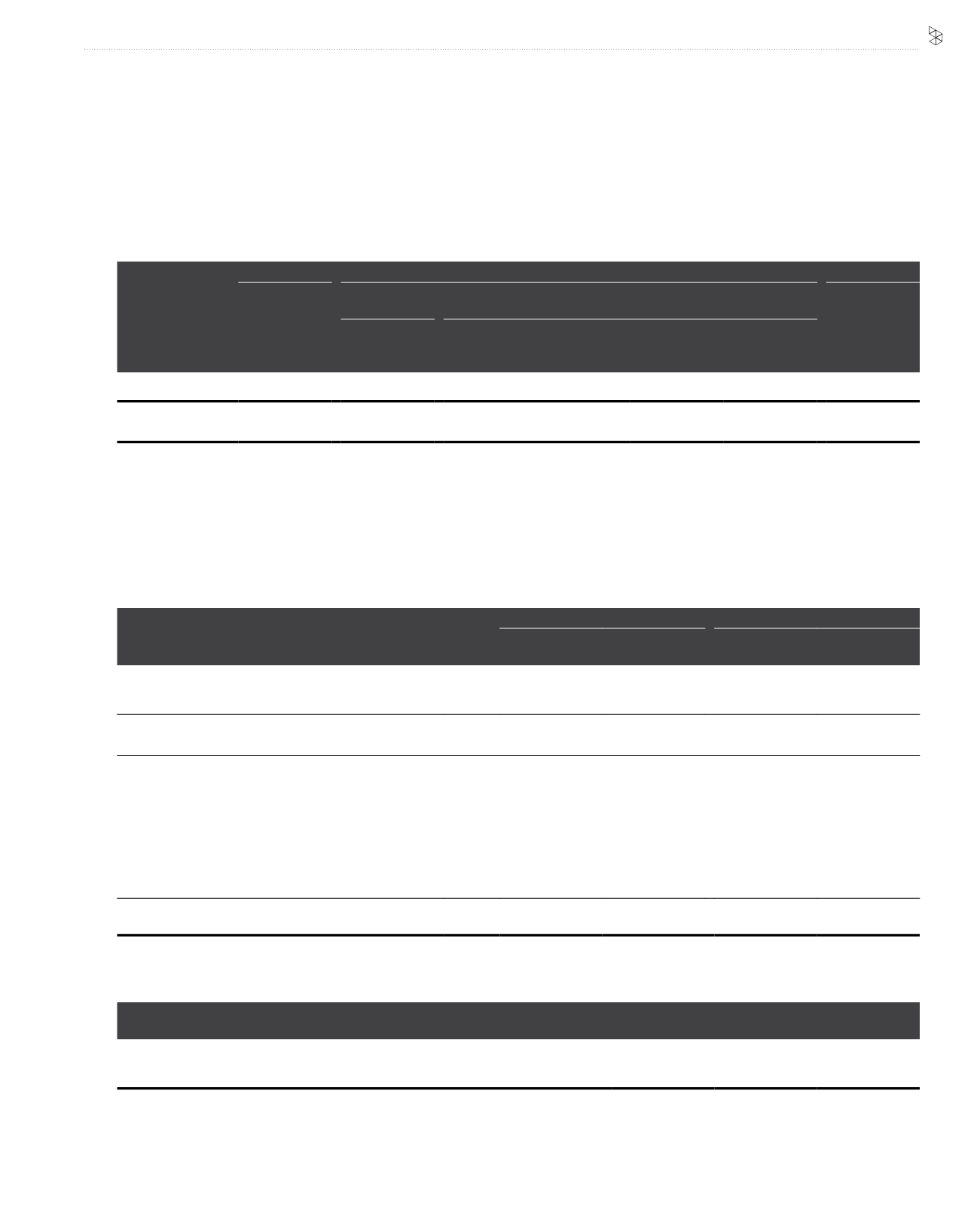

33. TRADE AND OTHER RECEIVABLES (CONTINUED)

Trade receivables which are due as at the end of the reporting period are as follows:

Not past due

Past due

Total

Specifically

impaired

Not specifically impaired

RM’000

RM’000

0-3

months

RM’000

3-6

months

RM’000

6-12

months

RM’000

Over 12

months

RM’000

RM’000

2016

568,931

12,262

491,306

118,441

37,870

167,350

1,396,160

2015

438,580

49,556

354,129

97,891

56,555

117,199

1,113,910

The Group is not exposed to major concentration of credit risk due to the diverse customer base. In addition, credit risk is mitigated to a certain

extent by cash deposits and bankers' guarantee obtained from customers. The Group considers the accumulated impairment losses of trade

receivables at the end of the reporting period to be adequate to cover the potential financial loss.

Credit terms of trade receivables for the Group range from 5 to 90 days (2015: 5 to 90 days).

34. DEPOSITS, CASH AND BANK BALANCES

Group

Company

Note

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

Deposits with licensed banks

2,469,770

2,564,105

-

-

Deposits under Islamic principles

431,086

1,295,000

201,085

245,000

Total deposits

2,900,856

3,859,105

201,085

245,000

Cash and bank balances

2,431,558

1,651,587

531,716

76,314

Total deposits, cash and bank balances

5,332,414

5,510,692

732,801

321,314

Less:

Deposits pledged

16(a)

(29,775)

(17,655)

-

-

Deposit in Escrow Account

(63,721)

(92,033)

-

-

Deposit on investment in a subsidiary of the Group

(320,717)

(64,380)

(269,160)

-

Deposits maturing more than three (3) months

(206,712)

(686,051)

-

-

Bank overdrafts

16

(62,067)

(89,908)

-

-

Total cash and cash equivalents at the end of the

financial year

4,649,422

4,560,665

463,641

321,314

The deposits are placed mainly with a number of creditworthy financial institutions. There is no major concentration of deposits in any single

financial institution. Maturity range of deposits is as follows:

(In days)

From

Group

To

Company

To

Financial year ended 31 December 2016

Overnight

365

91

Financial year ended 31 December 2015

Overnight

366

92