FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

221

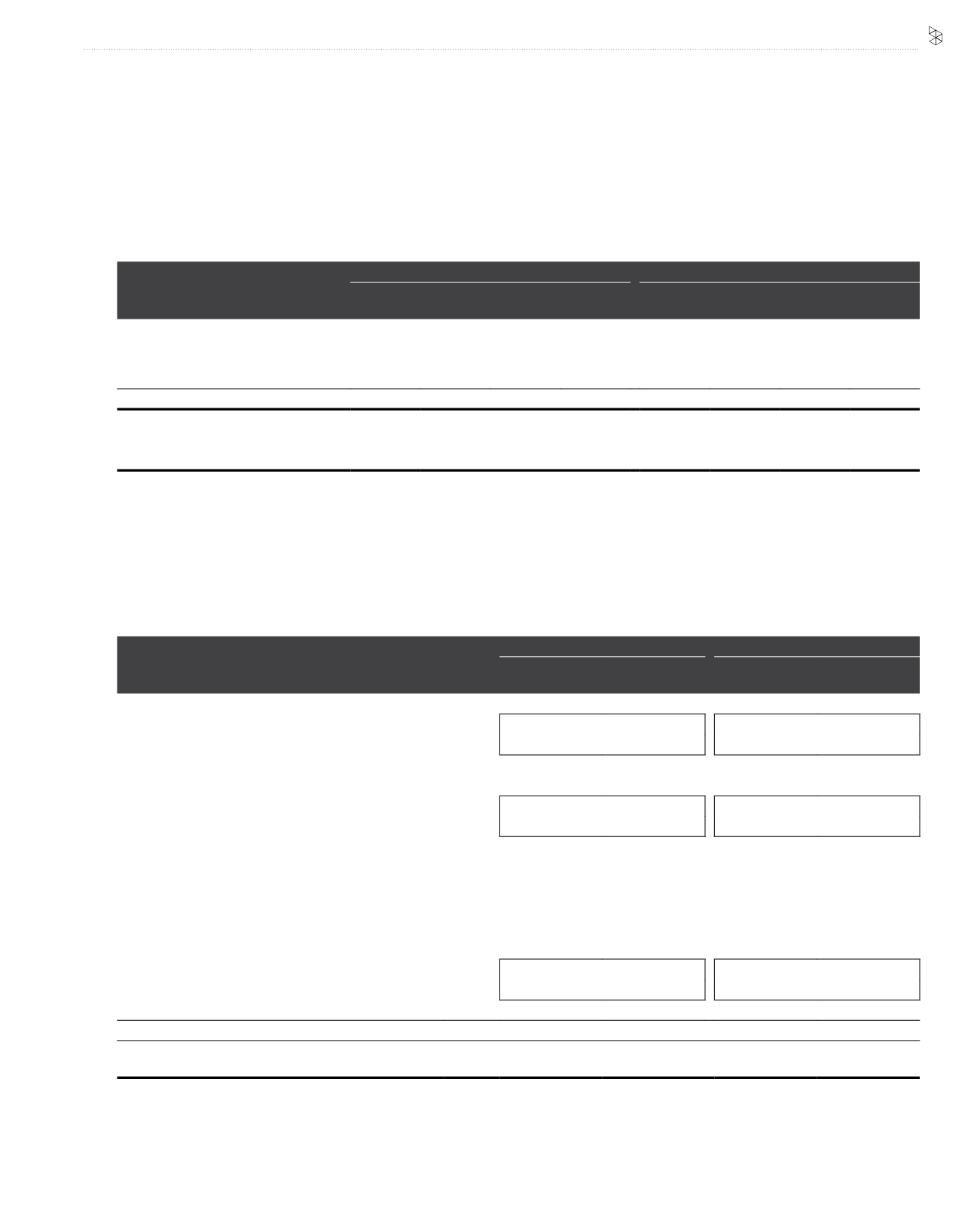

32. AMOUNTS DUE FROM/TO SUBSIDIARIES

The currency profiles of the amounts due from/to subsidiaries are as follows:

2016

2015

RM

RM’000

USD

RM’000

Others

RM’000

Total

RM’000

RM

RM’000

USD

RM’000

Others

RM’000

Total

RM’000

Amounts due from subsidiaries:

- Non-current

1

-

95,982

-

95,982

- 2,233,856

- 2,233,856

- Current

6,206 43,105

-

49,311

260,087 113,369 20,697 394,153

6,206 139,087

- 145,293

260,087 2,347,225 20,697 2,628,009

Amounts due to subsidiaries:

- Current

2

1,437,201 619,502

- 2,056,703

1,330,718 65,631

- 1,396,349

1

W.A.R.F. as at 31 December 2015 was 2.41% p.a..

2

Amounts due to subsidiaries include an amount of RM807.7 million (2015: RM807.7 million) which bears interest at 3.05% (2015: 3.05%) p.a..

Except as disclosed otherwise above, amounts due from/to subsidiaries are unsecured, interest free and have no fixed terms of repayment.

33. TRADE AND OTHER RECEIVABLES

Group

Company

Note

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

Trade receivables

1,793,966

1,466,094

-

-

Less: Provision for impairment

(397,806)

(352,184)

-

-

1,396,160

1,113,910

-

-

Other receivables:

Deposits

253,110

188,355

-

-

Less: Provision for impairment

(27,030)

(27,030)

-

-

226,080

161,325

-

-

Prepayments

2,025,869

1,749,383

898

805

Staff loans

2,458

837

-

-

Finance lease receivables

30

20,248

17,701

-

-

Other receivables

1,109,365

915,477

7,333

7,964

Less: Provision for impairment

(605)

(3,917)

-

-

1,108,760

911,560

7,333

7,964

Total other receivables after provision for impairment

3,383,415

2,840,806

8,231

8,769

Total trade and other receivables after provision for

impairment

4,779,575

3,954,716

8,231

8,769

A total fair value of trade receivables of RM228.2 million, which were acquired via business combination during the financial year as disclosed in Note

5(a) to the financial statements. The gross contractual amount for those trade receivables is RM247.1 million, of which RM18.9 million is expected to

be uncollectible.