Axiata Group Berhad | Annual Report 2016

FINANCIAL STATEMENTS

206

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2016

24. DEFERRED TAXATION (CONTINUED)

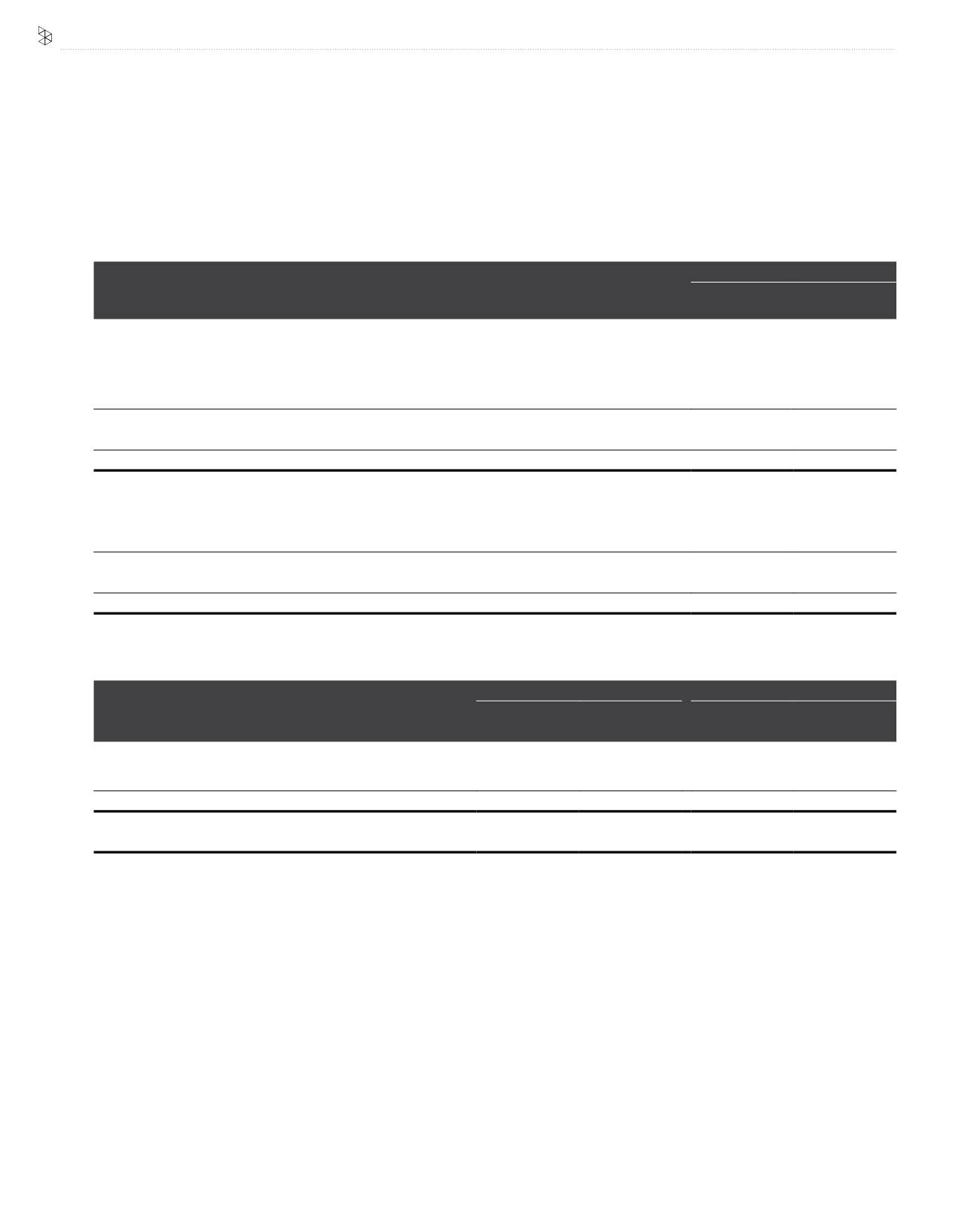

Breakdown of cumulative balances by each type of temporary differences of the Group:

Group

2016

RM’000

2015

RM’000

Deferred tax assets:

- PPE and intangible assets

594,515

15,839

- Tax losses

475,948

368,163

- Provision and others

388,384

577,764

Before offsetting

1,458,847

961,766

Offsetting

(1,167,214)

(713,610)

After offsetting

291,633

248,156

Deferred tax liabilities:

- PPE and intangible assets

3,369,004

2,464,733

- Others

39,716

58,193

Before offsetting

3,408,720

2,522,926

Offsetting

(1,167,214)

(713,610)

After offsetting

2,241,506

1,809,316

The amounts of deductible temporary differences and unutilised tax losses for which no deferred tax asset is recognised in the statements of

financial position are as follow:

Group

Company

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

Deductible temporary differences

170,056

145,887

47,229

48,959

Unutilised tax losses

506,216

405,161

133,032

125,086

676,272

551,048

180,261

174,045

Tax effect

162,305

137,762

43,263

43,511

The benefits of these tax losses and credit will only be obtained if the Company or the relevant subsidiaries derive future assessable income of a

nature and amount sufficient for the benefits to be utilised. The unutilised tax losses have no expiry date.