FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

205

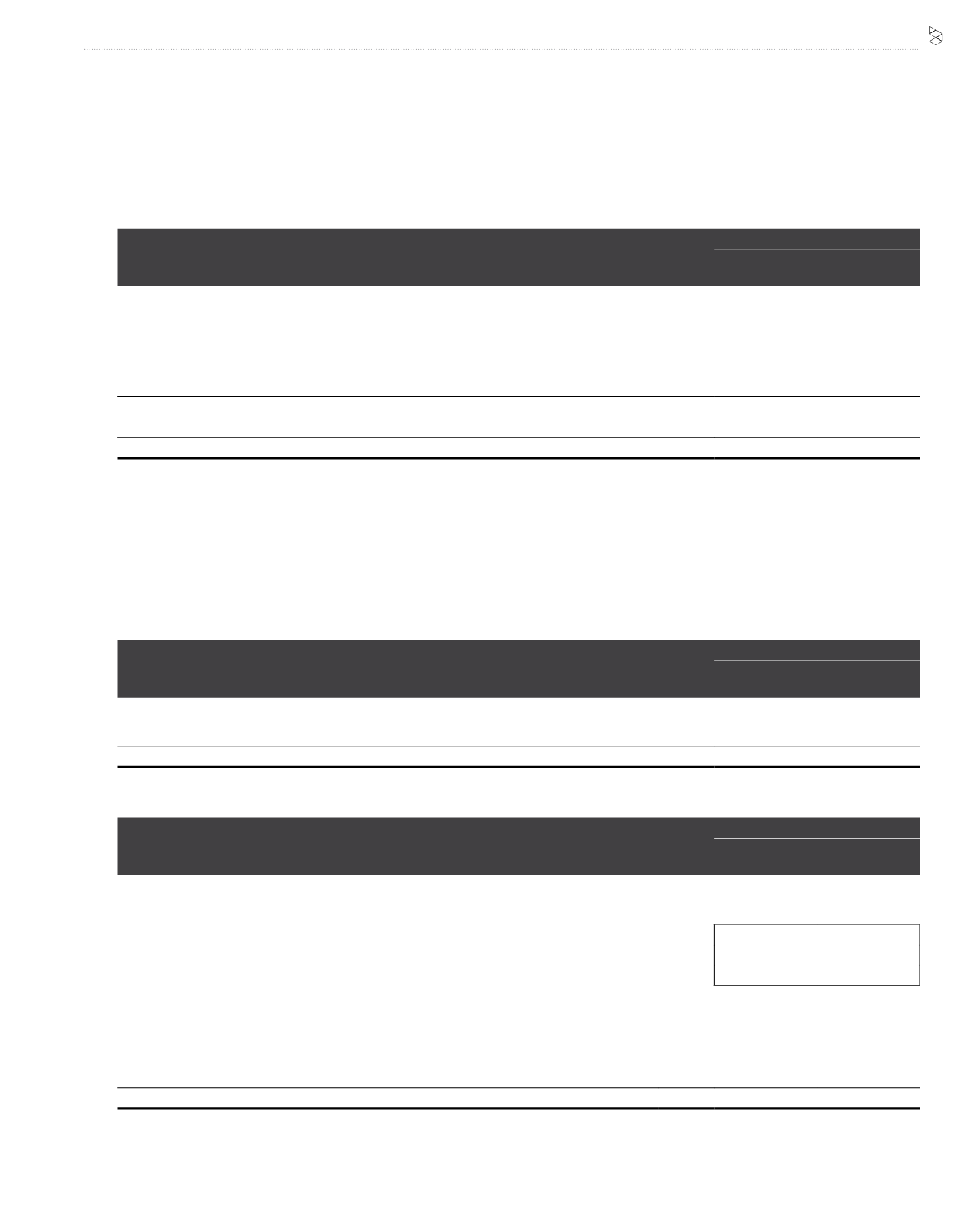

23. PROVISION FOR LIABILITIES

Group

2016

RM’000

2015

RM’000

At 1 January

417,574

295,005

Provision for the financial year

28,432

45,548

Acquisition of subsidiaries

56,813

66,221

Accretion of interest

10,114

7,512

Currency translation differences

24,024

24,557

536,957

438,843

Utilised during the financial year

(37,237)

(21,269)

At 31 December

499,720

417,574

The provision for liabilities relates to provision for dismantling costs of existing telecommunication network and equipment as disclosed in the

significant accounting policies in Note 3(o) to the financial statements.

24. DEFERRED TAXATION

Deferred tax assets and liabilities of the Group are offsetted when there is a legally enforceable right to set off current tax assets against current tax

liabilities and when the deferred taxes related to the same tax authority. The following amounts, determined after appropriate offsetting, are shown

in the statements of financial position:

Group

2016

RM’000

2015

RM’000

Deferred tax assets

(291,633)

(248,156)

Deferred tax liabilities

2,241,506

1,809,316

Net deferred tax liabilities

1,949,873

1,561,160

The movement in net deferred tax liabilities of the Group during the financial year is as follows:

Group

Note

2016

RM’000

2015

RM’000

At 1 January

1,561,160

1,379,073

Charge/(credit) to profit or loss:

- PPE

180,082

107,338

- tax losses

(162,092)

(208,936)

- provision and others

(94,467)

64,643

11

(76,477)

(36,955)

Acquisition of subsidiaries

432,209

(799)

Debit to OCI:

- actuarial reserve

2,335

3,445

Currency translation differences

30,646

216,396

At 31 December

1,949,873

1,561,160