FINANCIAL STATEMENTS

Axiata Group Berhad | Annual Report 2016

253

REPORT ON THE AUDIT OF THE FINANCIAL STATEMENTS (CONTINUED)

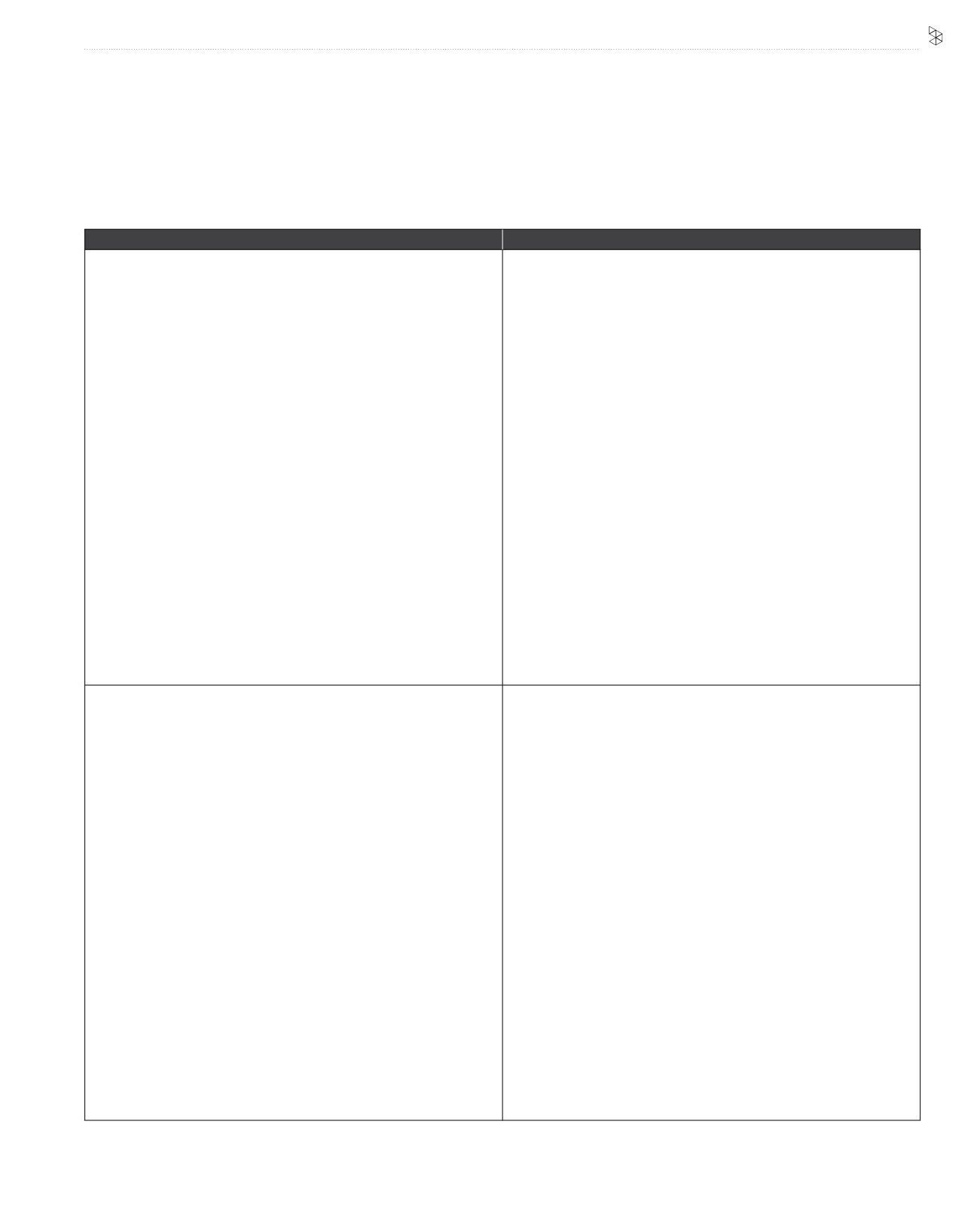

Key audit matter

How our audit addressed the key audit matter

Impairment assessment of goodwill in Indonesia

Refer to Note 3(b)(i) - Significant Accounting Policies – Goodwill, Note 4(b)(i)

Critical accounting estimates and assumptions – Impairment assessment of

goodwill and Note 25 - Intangible assets

As at 31 December 2016, the Group’s goodwill arising from its acquisitions in

Indonesia was RM5,439.7 million.

The Group is required to at least annually, test goodwill for impairment.

This area is important to our audit as the related CGU is experiencing

continued losses. Additionally the carrying amount of net assets of the

Indonesia subsidiary is higher than its market capitalisation.

Management’s assessment of the ‘value-in-use’ of this CGU involves

significant judgement about the future cash flows of the CGU.

We performed the following audit procedures:

•

We were assisted by our valuation expert in assessing the

appropriateness of the methodology adopted by management for

impairment assessment in accordance with MFRS 136 “Impairment

of Assets”. We found that the methodology used is acceptable;

•

We assessed discount rate, terminal growth rate and revenue growth

rate by reference to the comparable companies and the industries

in the same territory. We found that these assumptions used were

not materially different from our expectations based on comparable

industry data.

•

We compared the revenue growth rate to the historical performance

of the CGU and found this assumption to be materially consistent

with historical performance.

•

We re-performed on the sensitivity analysis performed by

management by stress-testing the discount rate, terminal growth

rate and revenue growth rate. We found no shortfall between the

stress-tested value in use calculations and the carrying value of the

CGU in the financial statements.

As indicated in Note 25, the impairment assessment is not sensitive to a range

of reasonable changes in assumptions which we found to be consistent with

the results of our stress test.

Impairment assessment of investment in an associate, Idea Cellular

Limited (“Idea”)

Refer to Note 3(e) - Significant Accounting Policies – Impairment of non-

financial assets (excluding goodwill), Note 4(b)(ii) Critical accounting

estimates and assumptions - Impairment assessment on non-financial

assets (excluding goodwill) and Note 29 - Associates

The Group has an investment in Idea, a listed associate, with a carrying

amount of RM6,711.6 million.

As of 31 December 2016, the carrying amount of the investment in

associate is higher than its fair value. The fair value was based on its share

price adjusted for block discount in accordance with its accounting policy as

stated in Note 3(e) to the financial statements. Accordingly, the Group had

tested the carrying amount of the investment in associate for impairment.

We focused on this area as management’s assessment of the recoverable

amount of the investment in associate involves significant judgement in

estimating the future cash flows.

We performed the following audit procedures:

•

We were assisted by our valuation expert in assessing the

appropriateness of the methodology adopted by management for

impairment assessment in accordance with MFRS 136 “Impairment of

Assets”. We found that the methodology used is acceptable;

•

We assessed discount rate, terminal growth rate and EBITDAmargin by

reference to the comparable companies and the industries in the same

territory. We found that these assumptions used were not materially

different from our expectations based on comparable industry data.

•

We compared the EBITDA margin to the historical performance of the

associate and found this assumption to be materially consistent with

the historical performance.

•

We re-performed on the sensitivity analysis performed by

management by stress-testing the discount rate, terminal growth rate

and EBITDA margin. We found no shortfall between the stress-tested

value in use calculations and the carrying amount of the investment in

associate in the financial statements.

As indicated in Note 29, the impairment assessment is not sensitive to a range

of reasonable changes in assumptions which we found to be consistent with

the results of our stress test.