Axiata Group Berhad | Annual Report 2016

FINANCIAL STATEMENTS

246

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2016

43. RELATED PARTY TRANSACTIONS (CONTINUED)

Key management personnel are the persons who have authority and responsibility for planning, directing and controlling the activities of the Group

or the Company either directly or indirectly. Key management personnel of the Group and the Company include the Senior Leadership Team who

report directly to the Group Chief Executive Officer.

Whenever exist, related party transactions also includes transaction with entities that are controlled, joint ventures or significantly influenced

directly by any key management personnel or their close family members.

In addition to related party transactions and balances mentioned elsewhere in the financial statements, set out below are significant related party

transactions and balances which were carried out on terms and conditions negotiated amongst the related parties.

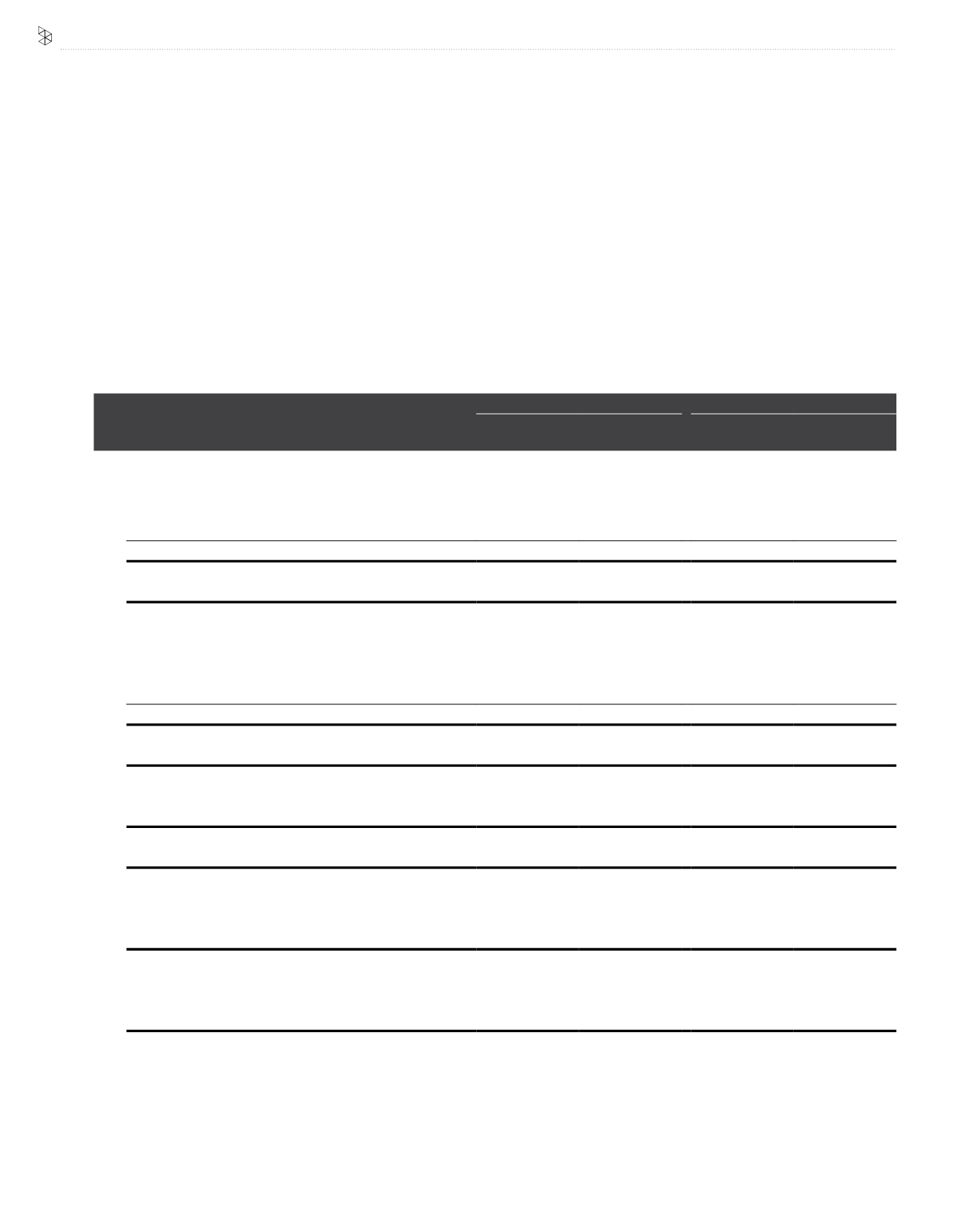

Group

Company

2016

RM’000

2015

RM’000

2016

RM’000

2015

RM’000

(a) Sale of goods and services:

Associates:

- International roaming revenue

14,312

13,635

-

-

- Telecommunication services

258,946

233,222

-

-

273,258

246,857

-

-

Joint ventures:

- Telecommunication services

406,285

611,463

-

-

(b) Purchase of goods and services:

Associates:

- Interconnection charges

11,751

13,979

-

-

- Leaseline charges, maintenance and others

69,220

63,799

-

-

80,971

77,778

-

-

Joint ventures:

- Revenue sharing

96,815

220,898

-

-

(c) Intercompany service agreement with subsidiaries:

- Technical and management services

-

-

47,435

48,142

(d) Dividends received from subsidiaries/associates

-

-

1,002,403

1,101,406

(e) Repayments from/(advances to) subsidiaries

- Advances

-

-

(2,593,067)

(175,430)

- Repayments

-

-

186,692

86,576

(f) Interest income/(expense) on advances (from)/to subsidiaries

- Interest income

-

-

10,657

47,006

- Interest expense

-

-

(24,701)

(24,819)

The outstanding balances as at reporting date are disclosed in Note 27 and Note 32 to the financial statements.