notes to tHe FinanCial stateMents

For tHe FinanCial Year ended 31 deCeMBer 2010

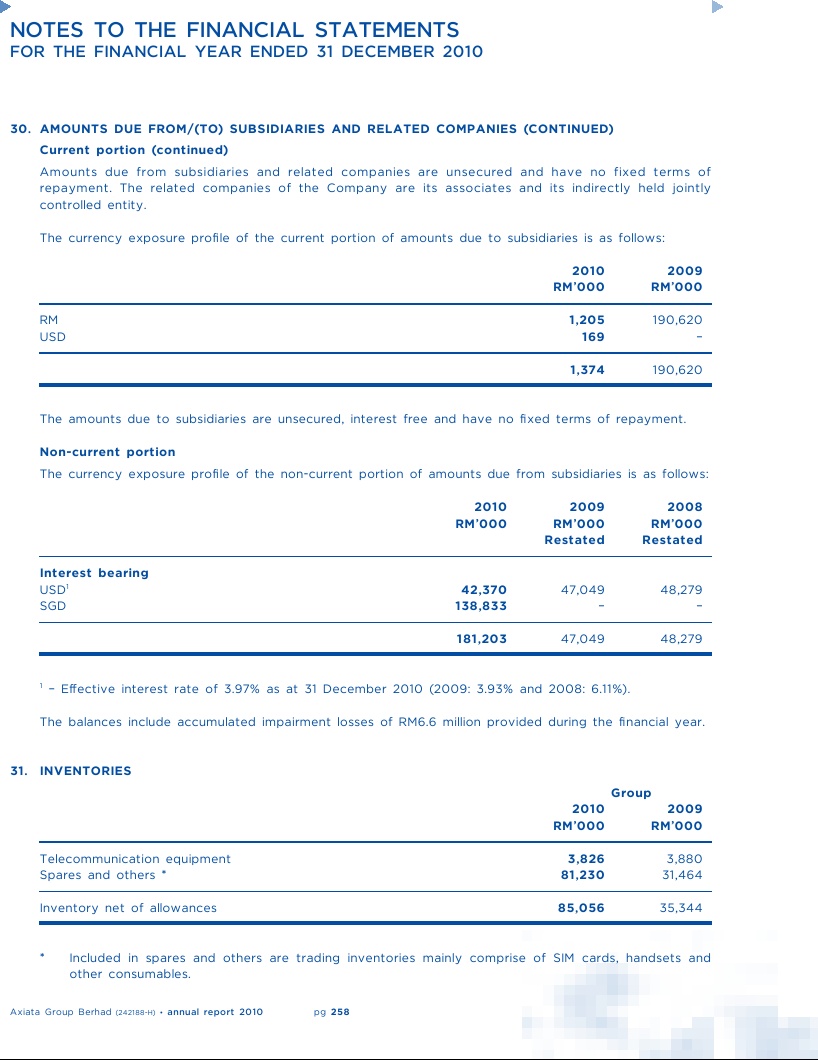

30. AMOUNTS DUE FROM/(TO) SUBSIDIARIES AND RELATED COMPANIES (CONTINUED)

Current portion (continued)

Amounts due from subsidiaries and related companies are unsecured and have no fixed terms of

repayment. The related companies of the Company are its associates and its indirectly held jointly

controlled entity.

The currency exposure profile of the current portion of amounts due to subsidiaries is as follows:

2010

2009

RM'000

RM'000

1,205

rM

190,620

169

uSd

1,374

190,620

The amounts due to subsidiaries are unsecured, interest free and have no fixed terms of repayment.

Non-current portion

The currency exposure profile of the non-current portion of amounts due from subsidiaries is as follows:

2010

2009

2008

RM'000

RM'000

RM'000

Restated

Restated

Interest bearing

42,370

uSd1

47,049

48,279

138,833

SGd

181,203

47,049

48,279

effective interest rate of 3.97% as at 31 december 2010 (2009: 3.93% and 2008: 6.11%).

1

The balances include accumulated impairment losses of rM6.6 million provided during the financial year.

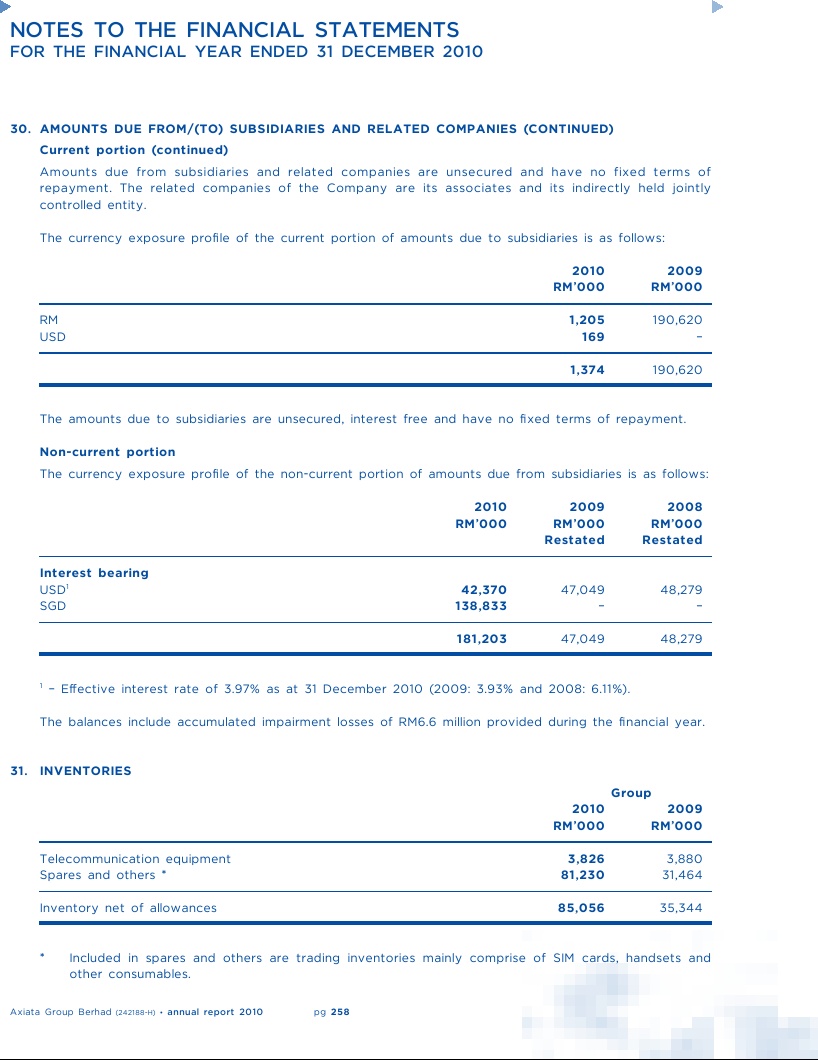

31. INVENTORIES

Group

2010

2009

RM'000

RM'000

3,826

Telecommunication equipment

3,880

81,230

Spares and others *

31,464

85,056

Inventory net of allowances

35,344

*

Included in spares and others are trading inventories mainly comprise of SIM cards, handsets and

other consumables.

pg 258

annual report 2010

Axiata Group Berhad

(242188-H) ·