notes to tHe FinanCial stateMents

For tHe FinanCial Year ended 31 deCeMBer 2010

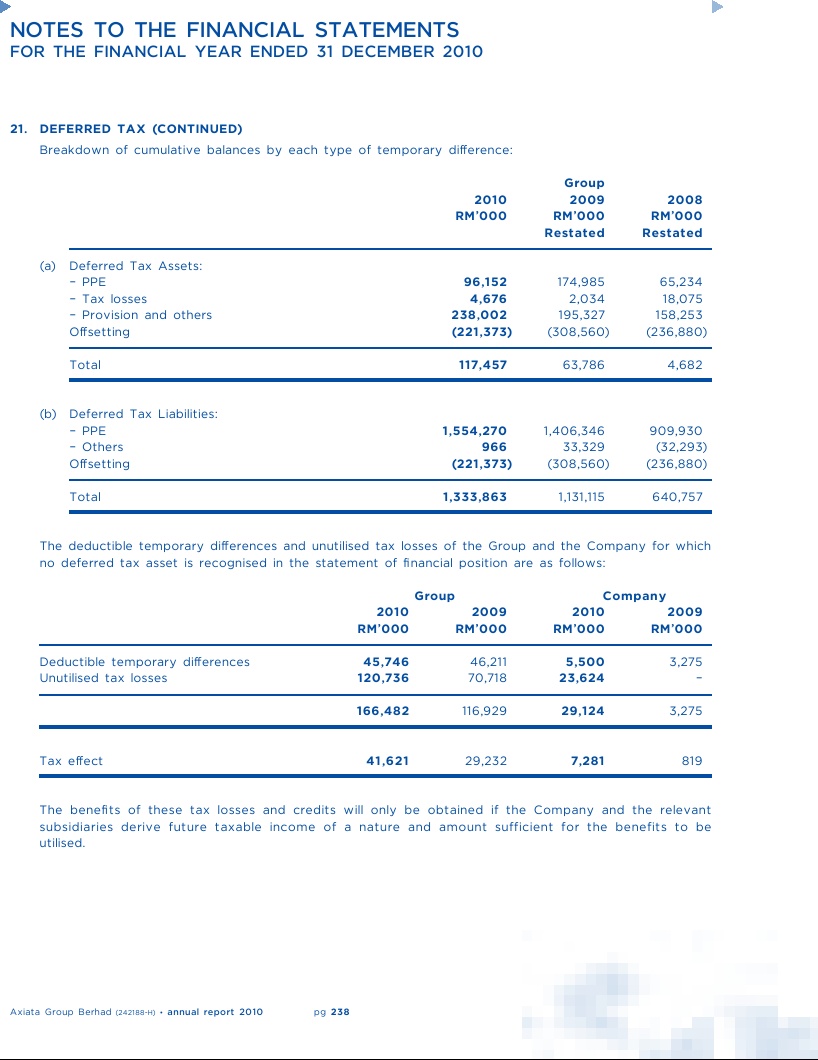

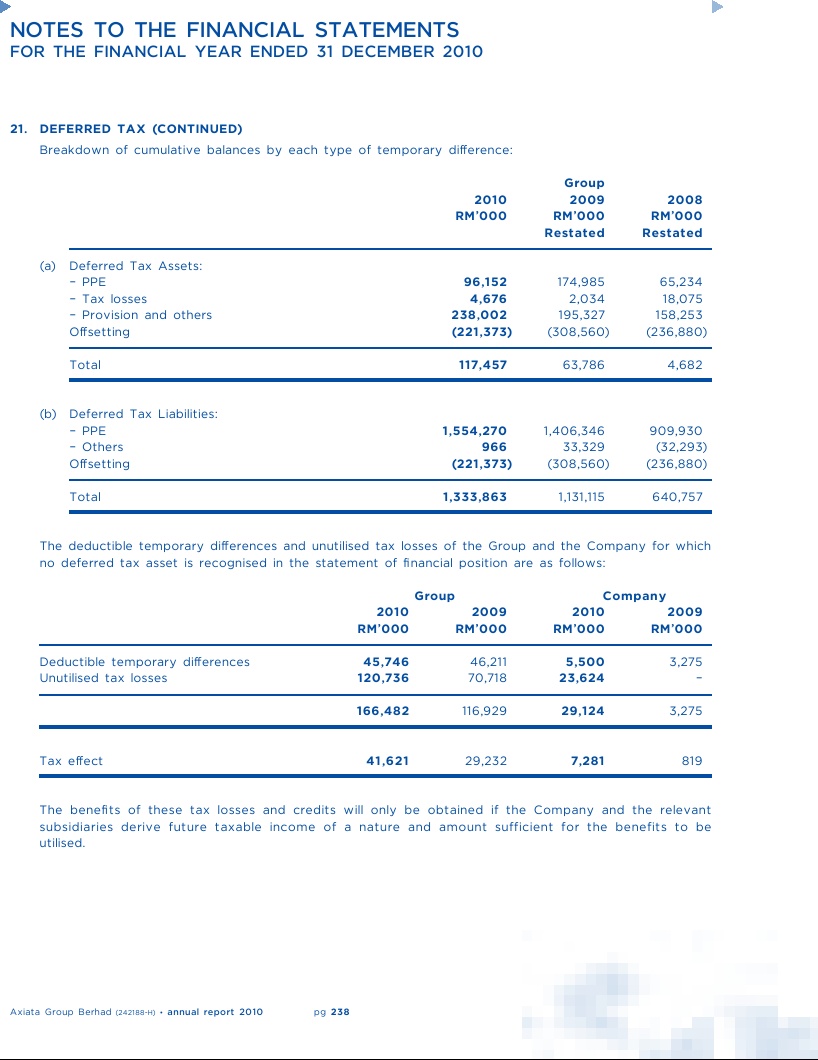

21. DEFERRED TAX (CONTINUED)

Breakdown of cumulative balances by each type of temporary difference:

Group

2010

2009

2008

RM'000

RM'000

RM'000

Restated

Restated

(a)

deferred Tax Assets:

96,152

PPe

174,985

65,234

4,676

Tax losses

2,034

18,075

238,002

Provision and others

195,327

158,253

(221,373)

offsetting

(308,560)

(236,880)

117,457

Total

63,786

4,682

(b) deferred Tax Liabilities:

1,554,270

PPe

1,406,346

909,930

966

others

33,329

(32,293)

(221,373)

offsetting

(308,560)

(236,880)

1,333,863

Total

1,131,115

640,757

The deductible temporary differences and unutilised tax losses of the Group and the Company for which

no deferred tax asset is recognised in the statement of financial position are as follows:

Group

Company

2010

2009

2010

2009

RM'000

RM'000

RM'000

RM'000

45,746

5,500

deductible temporary differences

46,211

3,275

120,736

23,624

unutilised tax losses

70,718

166,482

29,124

116,929

3,275

41,621

7,281

Tax effect

29,232

819

The benefits of these tax losses and credits will only be obtained if the Company and the relevant

subsidiaries derive future taxable income of a nature and amount sufficient for the benefits to be

utilised.

pg 238

annual report 2010

Axiata Group Berhad

(242188-H) ·