notes to tHe FinanCial stateMents

For tHe FinanCial Year ended 31 deCeMBer 2010

19. DERIVATIVE FINANCIAL INSTRUMENTS (CONTINUED)

Non-hedging derivatives

nancial instruments (continued)

(i)

(a)

Put option on the investment in Idea (continued)

The Call option expired unexercised on 23 october 2010 and the Group or the Company has

ceased to have any rights or obligations under the Call option.

Subsequent event after the financial position date relating to the Put option is disclosed in note

39 to the financial statements.

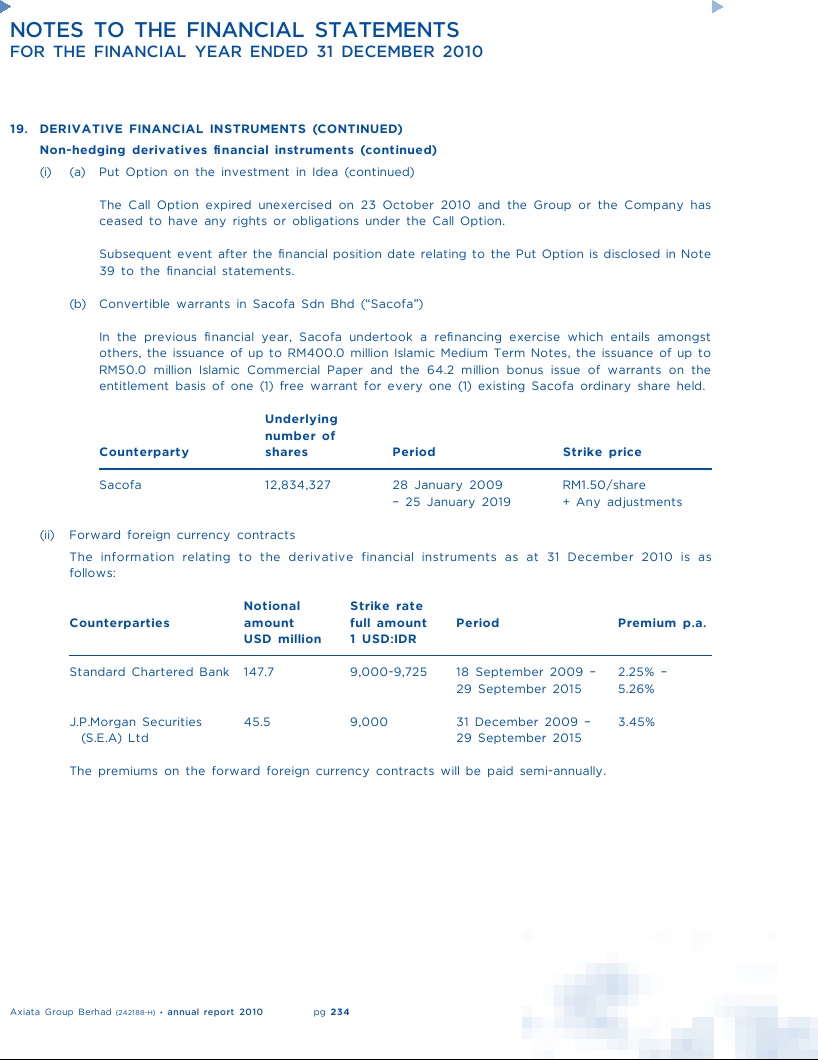

(b) Convertible warrants in Sacofa Sdn Bhd ("Sacofa")

In the previous financial year, Sacofa undertook a refinancing exercise which entails amongst

others, the issuance of up to rM400.0 million Islamic Medium Term notes, the issuance of up to

rM50.0 million Islamic Commercial Paper and the 64.2 million bonus issue of warrants on the

entitlement basis of one (1) free warrant for every one (1) existing Sacofa ordinary share held.

Underlying

number of

Counterparty

shares

Period

Strike price

Sacofa

12,834,327

28 January 2009

rM1.50/share

25 January 2019

+ Any adjustments

(ii)

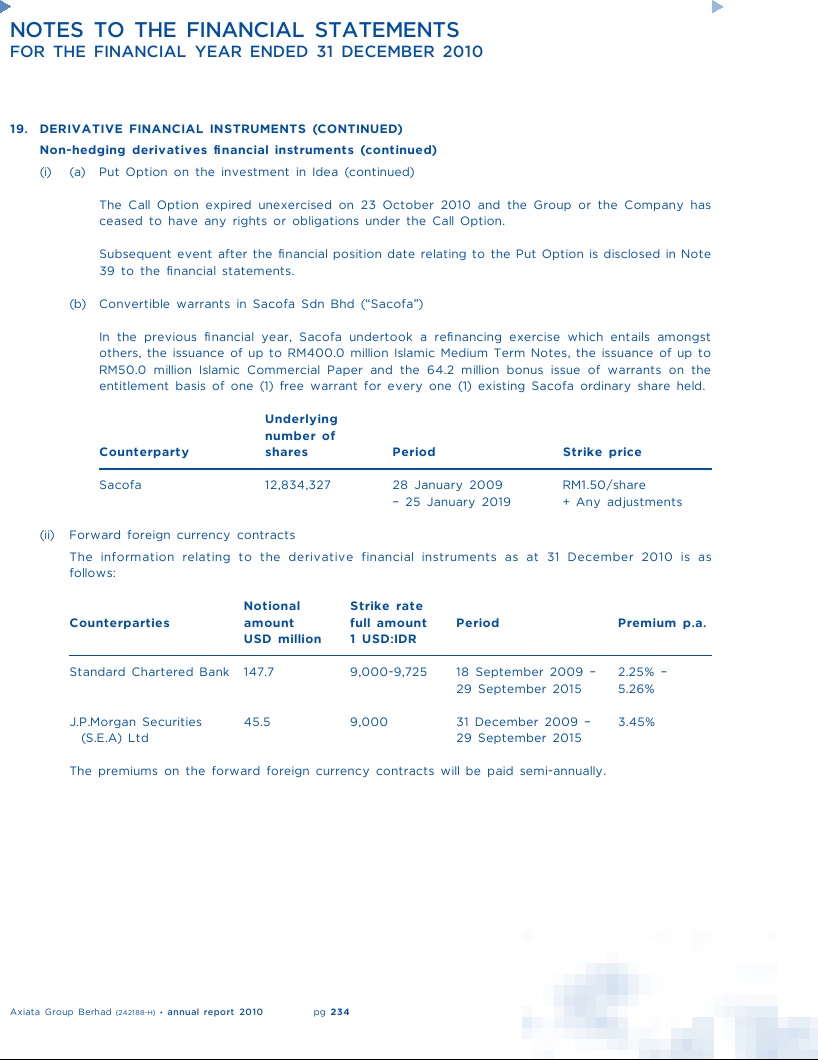

Forward foreign currency contracts

The information relating to the derivative financial instruments as at 31 december 2010 is as

follows:

Notional

Strike rate

Counterparties

amount

full amount

Period

Premium p.a.

USD million

1 USD:IDR

Standard Chartered Bank

147.7

9,000-9,725

18 September 2009

2.25%

29 September 2015

5.26%

J.P.Morgan Securities

45.5

9,000

31 december 2009

3.45%

(S.e.A) Ltd

29 September 2015

The premiums on the forward foreign currency contracts will be paid semi-annually.

pg 234

annual report 2010

Axiata Group Berhad

(242188-H) ·