notes to tHe financial statements

for tHe financial year enDeD 31 December 2008 (continued)

48 cHanGes in comparatiVes

(continued)

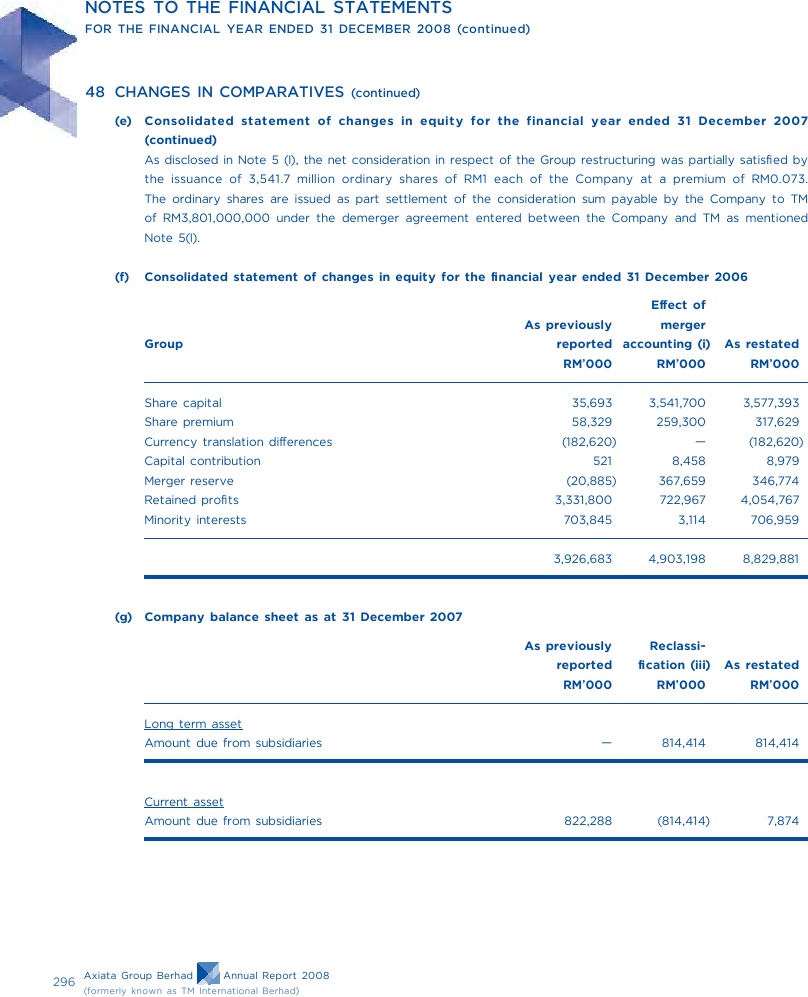

(e)

Consolidated statement of changes in equity for the financial year ended 31 December 2007

(continued)

As disclosed in Note 5 (I), the net consideration in respect of the Group restructuring was partially satis ed by

the issuance of 3,541.7 million ordinary shares of RM1 each of the Company at a premium of RM0.073.

The ordinary shares are issued as part settlement of the consideration sum payable by the Company to TM

of RM3,801,000,000 under the demerger agreement entered between the Company and TM as mentioned

Note 5(I).

(f)

Consolidated statement of changes in equity for the financial year ended 31 December 2006

Effect of

As previously

merger

Group

reported accounting (i)

As restated

RM'000

RM'000

RM'000

Share capital

35,693

3,541,700

3,577,393

Share premium

58,329

259,300

317,629

Currency translation differences

(182,620)

--

(182,620)

Capital contribution

521

8,458

8,979

Merger reserve

(20,885)

367,659

346,774

Retained profits

3,331,800

722,967

4,054,767

Minority interests

703,845

3,114

706,959

3,926,683

4,903,198

8,829,881

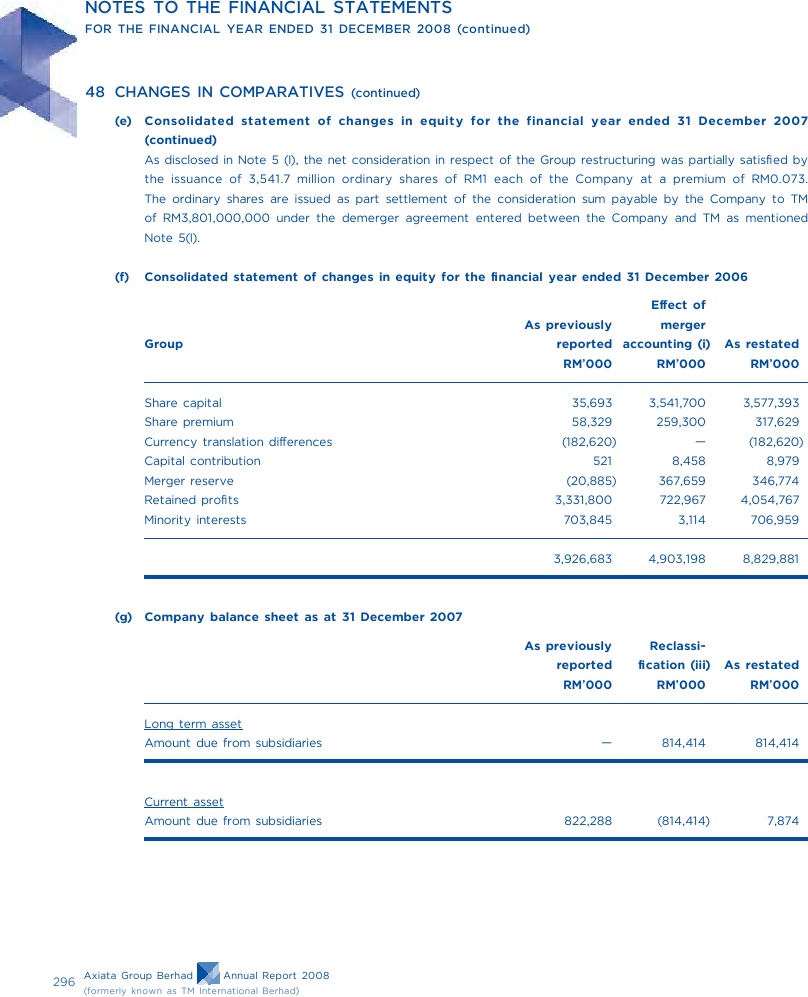

(g)

Company balance sheet as at 31 December 2007

As previously

Reclassi-

reported

fication (iii)

As restated

RM'000

RM'000

RM'000

Long term asset

Amount due from subsidiaries

--

814,414

814,414

Current asset

Amount due from subsidiaries

822,288

(814,414)

7,874

Axiata Group Berhad

Annual Report 2008

296

(formerly known as TM International Berhad)